Everyone has heard of ‘Obamacare’, properly known as the Affordable Health Care Act. Typically every media cycle has stories regarding the purported effects of Obamacare. And yet who has heard of the Medicare Surtax? The phrase appears to linger in obscurity as far as America’s major media outlets are concerned.

This seems strange since the Medicare Surtax is a primary funding mechanism for Obamacare. In addition to its efficacy as a funding mechanism, the Medicare Surtax is also a major step towards a more equitable federal tax system. This little known measure has broadened Medicare’s Tax Base by tapping into a heretofore sheltered source of revenue – Investment Income.

Who are the prime beneficiaries of this type of income? Wealthy America is the only sector that typically derives a significant percentage of its income from investments. Although the brunt of this tax is primarily borne by upper income groups, these same groups have maintained a public silence on this matter. Given the influence that the wealthy typically wield in our democracy, what is behind this conspicuous silence?

First, what is the Medicare Surtax? To better understand the significance of its role, let us briefly discuss the historical context of Medicare funding.

The Medicare Surtax

Ever since the 1980s, those who earn their money from a paycheck or are self-employed have paid 2.9% of their income towards Medicare. In other words, a flat-rate 2.9% Medicare Tax is levied on Earned Income. Few notice this federal tax because it is taken directly from the paycheck and is non-refundable. Before Obama’s Affordable Health Care Act, those who earned their money through investments, i.e. rentals, stocks, and interest, paid 0% of their income towards Medicare. In other words, Earned Income has completely funded Medicare up to this point. In contrast, Investment Income was exempted from Medicare taxes when politicians drew up the initial funding legislation.

This tax structure was regressive in that it favored those with the greatest ability to pay taxes. Low wage earners have difficulty generating enough savings to make money from investments. Therefore in general, the entire earnings of those with the least ability to pay were subject to the Medicare Tax. In contrast, the well-to-do have substantial capital with which to generate a significant amount of money from Investment Income. Therefore much of the income of wealthier Americans was not subject to this tax.

This situation changed with the passage of the Affordable Health Care Act of 2010, a.k.a. ‘Obamacare’. This landmark legislation instituted a new tax called the Net Investment Income Tax, often popularly called the Medicare Surtax. This so-called surtax included Investment Income in the Tax Base for Medicare for the first time in its half century of operation. Let’s look at the details.

To fund the expansion of Medicare beyond those over 65 years of age, Congress increased the tax contribution for those individuals whose income is over $200K/year and for couples whose income is over $250K/year. This tax increase has 2 parts.

One change introduced an extra 0.9% tax levy on Earned Income, for instance wages and salaries, above these thresholds. The Medicare Tax on Earned Income below these same thresholds continued to be taxed at the previous rate of 2.9%. In other words, Earned Income above $200K for individuals and $250K for couples is now taxed at a 3.8% rate.

The second change broadens Medicare’s Tax Base by introducing a unprecedented tax on Investment Income. Vanguard Investments Tax Center provides the details in the following excerpt:

“The Affordable Health Care Act also included a provision for a 3.8% Net Investment Income Tax. … The tax, which went into effect January 1, 2013, applies to what the IRS classifies as ‘certain unearned income,’ including taxable interest, ordinary dividends, and capital gains distributions from investments, as well as nonqualified annuities, rents, royalties, passive income from business activities, and undistributed income from a trust or estate.”

This was the first time that Congress targeted Investment Income as a source of funding for Medicare. However, not all Investment Income is subject to the Medicare Surtax. The IRS takes Total Income into account when assessing the tax liability for Medicare. Total Income equals Net Investment Income plus Earned Income. If an individual’s Total Income is below $200K or a couple’s Total Income is below $250K, they are not required to pay Medicare Taxes on their Investment Income. (In contrast, Medicare taxes are levied on all Earned Income.)

Net Investment Income is only subject to the 3.8% Medicare Surtax, when these thresholds are exceeded. Net Investment Income equals Investment Income minus Expenses. Only Net Investment Income above the aforementioned thresholds is taxed at this rate. As an example, if an individual has $150K in Earned Income and $100K in Investment Income, he only pays the 3.8% Medicare Surtax on the $50K in Investment Income that exceeds the Total Income threshold.

In other words, the Affordable Health Care Act only increased the Medicare tax liability for those individuals whose Total Income exceeds $200K and those couples whose Total Income exceeds $250K. Further this was the first time that Investment Income was included in the tax accountant’s Medicare equation. Reiterating Medicare taxes remained the same for those earning less than these threshold amounts.

The following 2 tables provide a visualization of the 2 Medicare tax changes discussed above:

| Before Obamacare | After Obamacare | |

|---|---|---|

Earned Income below threshold* |

2.9% |

2.9% |

Earned Income above threshold* |

2.9% |

3.8% |

| Before Obamacare | After Obamacare | |

|---|---|---|

Net Investment Income: |

0% |

0% |

Net Investment Income: when Total Income is above threshold* |

0% |

3.8% |

* Threshold: $200K for an individual or $250K for a couple

We applaud Obama and his Affordable Health Care Act for removing at least some regressivity from the US Federal tax system. Previously, the Medicare Tax was only applied to Earned Income. With the passage of the Health Care Act, the Medicare Tax is now applied to Investment Income as well. Everyone who makes money contributes to Medicare, not just wage earners. With the Medicare Surtax, the Health Care Act has reduced the regressive nature of the system by broadening the tax base to include a reasonable definition of all income.

The Medicare Surtax also introduces a modicum of progressivity into the taxes that fund Medicare. When the Total Income of an individual exceeds $200K ($250K for couples), the income above these thresholds is taxed at a slightly higher rate. We agree with the obvious intent of the authors of this legislation that it is reasonable to expect those with the greatest ability to pay to contribute a greater share to the smooth operation of a balanced society. In that it spreads the Medicare tax responsibility to all forms of income, the Medicare Surtax is a small social step towards a more equitable tax system.

A Brief History of Medicare Taxation

In this exploration of Medicare taxes, a distinct pattern begins to emerge regarding federal taxation. This pattern appears in the history of both the Federal Income Tax and the Medicare Tax. It also seems to be at work in our government’s current approach regarding Social Security Taxation (the topic of the next article). Due to this intimate linkage, let us explore this pattern in more detail.

At key moments in American history when tax policy was being shaped, powerful interests were at work defining the nature of those policies. When new taxes were considered, laws were instituted that exempted certain types of income from the available tax base. For instance, when the American Constitution was framed, Congress was granted the power to tax Earned Income, but Investment Income (such as rents, stocks and interest) was excluded from the tax base.

Investment Income tends to be the province of the wealthy. In fact, it provides a substantial portion of their total income, as we shall see below. As such, the functional effect of protecting this income from government taxation is to reduce the progressivity of any tax measure. Protecting a portion of a wealthy citizen’s income from taxation inevitably increases the tax burden on all other citizens to compensate for the obvious shortfall of needed revenue.

With a European war brewing in 1913, the US Government was desperately in need of more revenue to fund an effective military effort. To this end, the 16th Amendment to the Constitution was ratified. This enabled Congress to include Investment Income, for the first time, as part of the available tax base. Previously Investment Income was excluded and only Earned Income was subject to federal taxation. In addition to generating more revenue, this broadening of the tax base was a significant step towards a reasonable notion of tax justice, where each citizen pays taxes on his actual income.

In similar fashion to the Federal Income Tax, Congress initially excluded certain types of income from the tax base for both Social Security and Medicare. Let’s examine the history of these two types of federal taxation to better understand the significance and relevance of these exclusions.

The Social Security Tax is used to provide old age, survivors, and disability insurance (often abbreviated as OASDI). The Medicare Tax is used to provide hospital insurance benefits (often abbreviated as HI) for those 65 years and older.

The Medicare Tax has been linked with the Social Security Tax from its very inception. The Medicare Tax (HI) was patterned after the Social Security Tax (OASDI). Both are payroll taxes in that they are taken directly from a paycheck. Tax laws also require the employer to match the tax contribution of the employee. 2

When did this system begin and how did it evolve into its current state?

In 1937, the Roosevelt Administration passed legislation designed to provide ‘old age, survivors, and disability insurance’. This was the beginning of the Social Security System. To fund the program, a 1% OASDI tax was deducted from every paycheck. This tax was matched by an equivalent contribution from the employer.

In 1966, the Johnson Administration passed legislation designed to provide medical assistance for those over 65 years of age. This was the beginning of Medicare. To fund this program, a 0.35% HI tax was deducted from every paycheck. As with the Social Security tax, the Medicare tax was also matched by the employer.

To ensure solvency for the program, the Social Security (OASDI) tax rate rose gradually over the decades following its inception. By 1966 when Medicare was first instituted, the OASDI tax had risen to 3.85%. Including the newly adopted 0.35% HI tax, the combined taxes were 4.2%. The employer matched the employee taxes to generate a functional tax rate of 8.4%.

However, these percentages present a distorted picture. All income was not taxed at this rate. In fact 2 significant sources of income were excluded from the tax base. The first exclusion was for Investment Income. Recall that this enormous Federal Income tax loophole was also written into the original US Constitution, and was finally closed by the 16th Amendment. The second exclusion is commonly referred to as an Income Cap. Income above a specified threshold was sheltered from these taxes as well.

For instance when the Social Security Tax (OASDI) was first instituted in 1937, it only applied to income equal to or under $3K. In other words, income above $3K was not subject to mandatory withholding. In government terminology, the Maximum Tax Base for Social Security was $3K per person. In popular lexicon, the Income Cap was $3K.

When the Medicare Tax (HI) was first instituted in 1966, the Maximum Tax Base, i.e. Income Cap, was $6.6K per person. In other words, the combination of Medicare and Social Security Taxes was only levied on income up to $6.6K. Reiterating to reinforce understanding, income above $6.6K was sheltered from this tax.

From 1966 through 1990, the Income Cap, i.e. the Maximum Tax Base, for Social Security and Medicare was identical. During these decades, the Cap rose to $51.3K. In 1991, the Cap for the Medicare Tax (HI) rose independently of the Social Security Cap. In 1994, the Clinton Administration eliminated the Cap on the Medicare Tax. Then in 2010 with the passage of the Affordable Health Care Act, the Obama Administration included Investment Income for the first time in the Tax Base for Medicare (HI).

Broadening the Medicare tax base to include most, if not all, forms of income enhances the equity of the federal tax system. Removing caps on higher income Americans and including Investment Income dramatically enhances the solvency of the program. Indeed, many statisticians claim that the Medicare Surtax has added an extra 10 years onto the solvency of Medicare. It does so without increasing taxation on the rest of tax-paying Americans. When all sources of income are included in the tax base for Medicare, taxes better reflect a citizen’s ability to pay and are therefore more in line with a more enlightened conception of an equitable tax system.

While the taxable base for the Federal Income Tax and the Medicare Tax includes both Earned and Investment Income, the Social Security Tax lags behind in this regard. Investment Income is still excluded from the tax base of the Social Security Tax (OASDI) and there is still an Income Cap, currently set at $117K. In other words, Social Security Taxes are not levied upon Earned Income above $117K or upon Investment Income at all. When the solvency of Social Security is called into question, we would be wise to remember these sources of untapped tax revenue.

Why are Wealthy Investors silent regarding the Medicare Surtax?

Historically Federal Income Taxes excluded Investment Income from the Tax Base until the ratification of the 16th Amendment. The initial Medicare Tax also excluded Investment Income until the passage of the Affordable Health Care Act. Currently, the Social Security Tax continues this same exclusion. Why has Investment Income been targeted for exclusion from the Tax Base so often?

Of course, many of us earn some money from Investment Income. But what percentage of our income results from investments? For most of us, Investment Income is either non-existent or supplementary – certainly nothing to survive on. More of us are far more reliant upon Earned Income to pay our bills.

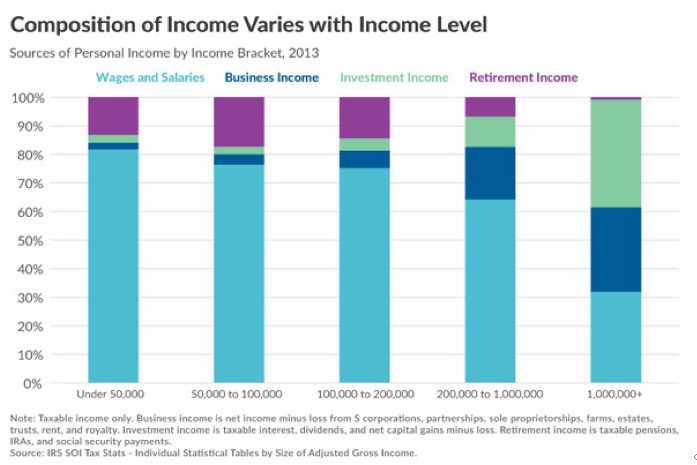

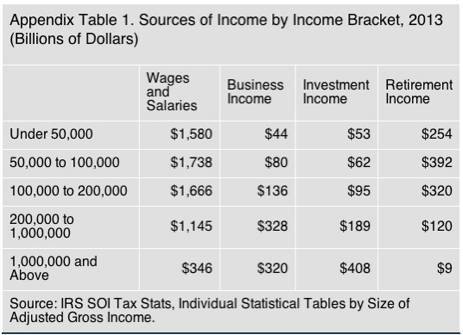

Let us look at a current 2013 graph of income distribution to get a little better sense of who is making money from Investment Income.

Interesting. Those earning over a million dollars a year generally receive a substantial portion of their earnings from Investment Income, i.e. interest, dividends, and capital gains. Nearly 40% of all the income generated by those in the graph’s top bracket is Investment Income. Only for the million-dollar per annum income group does the percentage for Investment Income actually exceed the percentage earned by either Business or Earned Income.

The group in the next bracket down on the average earns 15% of their income from investments, while those in the lower brackets receive even smaller percentages. In every bracket, other than the top bracket, Earned Income far exceeds the Investment Income generated by interest, dividends, and capital gains. Roughly 60% to 80% of total income in all other brackets is derived from wages and salaries.

Why are so few of us aware of the historical tendency of Congress to exclude Investment Income from the Federal tax base? Why has this prominent source of income for the super wealthy been sheltered from the reach of federal taxation in so many cases? What led or enabled the Obama Administration to include Investment Income in the Medicare tax base? Why have we heard so little about the tax implications associated with Obama’s Medicare Tax?

Typically any attempt to raise taxes ignites fierce opposition. Investment Income had been sheltered from Medicare Taxes for nearly half of a century. What happened to the traditional resistance? Why was there not an outcry to continue protecting this form of income from taxation?

The silence seems highly suspicious. Forest insects and fauna become dead silent when an outsider enters their domain. Quietly invisible, they hope that the intruder will not notice them and will instead pass on through and leave them alone. By their silence, they hope to avoid further scrutiny that might lead to their own discomfort.

Does the public silence regarding the groundbreaking Medicare Tax Surtax indicate motivations of a similar ilk? Do those who regularly challenge increases in taxation hope to be invisible in this instance? Why have affluent investors remained so quiet when the Affordable Health Care Act placed an automatic tax upon their investments?

President Obama succeeded in expanding the federal role in providing medical coverage for millions that were previously uncovered. How was he able to overcome the predictable opposition to the increase in taxes that were necessary to fund this new program? Perhaps Obama was astute enough to understand that wealthier Americans would be reluctant to engage in a public debate about this new tax on their investments. Such an open discussion would draw attention to the fact that a significant portion of their income was sheltered from tax rates that apply to all other Americans.

Is it possible that resisting this form of taxation would risk politically isolating the wealthy from the rest of taxpaying Americans? In the case of the Net Investment Income Tax, a.k.a. the Medicare Surtax, Obama sheltered less affluent Americans, i.e. those making less than the $200K/$250K thresholds in Total Income, from any increase in taxes. Typically tax resistance movements attempt to include a wide range of taxpayers in an attempt to generate broad-based political support for their proposals. However, only the wealthiest Americans tend to substantially benefit from sheltering investment income from the tax base. Could the risk of political isolation be why they have chosen to silently resent this new tax, rather than openly drawing attention to the untapped tax potential of this significant source of revenue?

While the Affordable Health Care Act increased taxes for wealthier Americans, i.e. those with substantial Investment Income, it has merely required them to pay what the working class had been paying on Earned Income for decades. It would be difficult to argue that it is unjust for the wealthy to join the rest of America by paying taxes on all significant sources of income. In fact, it would be quite defensible to argue for an even higher tax rate on this special source of income for the particularly well off.

Vague allusions, often lacking in substance, are employed to criticize the Affordable Health Care Act. It is easy to get sidetracked by such buzzwords as: 'unaffordable', 'unworkable', ‘job-killer', 'erosion of personal freedom', ‘unfair taxation', 'bureaucratic nightmare', 'out-of-control budget deficit', 'runaway socialism', even 'communism'.3 Could these unfounded objections to the Obama plan be cloaking a different set of motives – tax concerns that are only shared by the very prosperous?

It would be difficult to argue that Investment Income should be exempted from Medicare Taxes, when even those earning minimum wage have this tax withheld automatically from their paychecks. No matter how the topic is articulated, it would be a challenge to convince the voting public that taxing Investment Income in the same manner as Earned Income is somehow unfair. We suspect that this may be why most big investors are publicly silent about the Net Investment Income Tax.

Could it be that those with a substantial amount of Investment Income are afraid that its inclusion in the Medicare Tax Base might set an uncomfortable precedent? Might silence indicate a strategy that intends to minimize public awareness of this sheltered element of the potential tax base? Is it possible that investors are petrified that Investment Income might soon be included in the Tax Base for Social Security as well?

Certainly this underutilized source of tax revenue has great potential for addressing any solvency problems that the future Social Security System might face. If the Medicare Surtax was taken as a template for funding, only Investment Income above a certain threshold would be subject to this new Social Security tax. In contrast, most small investors, those who are least able to afford additional taxes, would be exempt from this tax increase. As painful as the 3.8% Medicare pill was to swallow, it is not as painful as swallowing the 12.5% Social Security pill, if that tax loophole were to be closed.

America’s Social Security Taxes are even more regressive than the Medicare Tax was prior to Obamacare. (For a deeper understanding of the regressive nature of Social Security Taxes, check out the article – Is the US Tax System really Progressive?) We can only hope that enlightened leaders introduce a similar change to Social Security in future legislation. The following chart indicates that no Social Security taxes are levied on either Investment Income or Earned Income over $120K. Is this fair?

Investment Income |

0% |

|---|---|

Earned Income under $120K |

15.3% |

Earned Income over $120K |

0% |

When fear mongering regarding the solvency of Social Security reaches the headlines, it would be wise to remember the sources of untaxed revenue revealed in the above table. To understand the issues behind this complex question, check out the next article in the tax reform series – Why the United States can afford Social Security..

Appendix

Footnotes

2 “Social Security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance (HI) benefits. Employers and employees each pay the applicable percentages for OASDI and HI. Together the employer and employee shares of OASDI and HI taxes are known as FICA (Federal Insurance Contributions Act). Since 1984 self-employed individuals pay the equivalent of both the employer's and employee's share of FICA.” (Department of Health and Human Services, Social Security Administration.)

3 Although a number of buzzwords are employed to criticize the Affordable Health Care Act, we suggest that much of the rhetorical storm mischaracterizes the far-reaching effects of this federal effort to dramatically improve the health care system.

Noted economist Paul Krugman disputes these harsh misrepresentations with some sobering facts: “The usual false claims that Obamacare has destroyed ‘millions’ of jobs and caused premiums to ‘skyrocket’ [run counter to the record]. Job growth since the Affordable Care Act went into effect has been the best since the 1990s and health costs have risen much more slowly than before.” (New York Times, February 2016)

Clearly one expert’s perspective cannot be considered conclusive. However we do believe that Mr. Krugman’s commentary warrants respect. An empirical examination of the topic is far more fruitful than a knee-jerk response to unfounded, negative speculation.

Tax Justice Articles: Bullet Points

1. The Dangerous Origins of Free Market Capitalism: How free market capitalism results in the first Ponzi scheme; the near bankruptcy of France; peasant starvation; and then the French Revolution. Why regulation is mandatory.

2. A Brief History of Progressive Taxation: How progressive taxation combined with a social safety net tempers the boom-bust cycle that is innate to free market capitalism.

3. Why the US Tax System is not Progressive: The Tax Burden Myth: How Social Security is a Working Class Tax. How Unearned Income, the province of the wealthy, is not included in SS's tax base.

4. Why the Rich really hate Obamacare: a Reverse Cap Tax on Investment Income How Obamacare includes Unearned Income for the first time ever in the tax base of Medicare – still not SS. How a Reverse Income Cap ($200,000) shelters the small investor from this tax. Why the Wealthy are afraid to confront this revolutionary precedent: the same process could be easily applied to SS taxes.

5.A Brief History of the Social Security System & Why it is Affordable: How the Social Security System benefits many classes of deserving American citizens besides the working class. How the SSS could be afforable for many decades to come by merely including Unearned Income, the province of the wealthy, in its tax base.

6. A Brief History: Empire vs. Tribe

The Tribal model of government is egalitarian.

Its primary focus is to both protect and encourage the growth and health of all citizens, in brief Peace.

Everyone contributes to the common good based upon their ability.

The Empire building model is hierarchical, i.e. roughly based upon a two-tier class system: wealthy and poor.

The focus of the wealthy class is upon the military or economic conquest of weaker cultures, in brief War.

The wealthy consider the rest, e.g. soldiers and workers, to be disposable property.

They believe the poor should fend for themselves after they have served their purpose.

America's tax system is based upon the Empire-building model.

The Working Class & Poor fend for themselves as the wealthy pay Income the Investment Income of the wealthy is excluded Social Security's tax base.