Section Headings

- The Necessity of Government Taxation

- Balancing Necessities vs. Balancing Luxuries

- Early History: Progressive Tax System to fund War

- Keynesian Economics

- Progressive Taxes to temper Boom-Bust Cycle

- Progressive Taxation with Integrity (1946-1979)

- Milton Friedman (1912-2006): Negative Income Tax

- Modern History: Reaganomics guts Progressivity of US Tax System

- Consequences: from Bush Sr. to Obama

- A Call to restore Progressivity to the US Tax System

- A Proposal to increase the Progressivity of the US Tax System

- Appendix: Graphs and Charts

Synopsis

Progressive taxation is based around the notion that those who have the greatest ability to pay should pay the highest percentage of their income in taxes. Progressive taxation was first proposed by Abraham Lincoln to finance the Civil War and then by Woodrow Wilson to finance World War I. The idea was that those with the greatest ability to pay and the most invested in the welfare of the society should be taxed at the highest rates. The reality was that taxing everyone equally, a flat tax, could not possibly raise sufficient revenue.

The next war was economic, not military. The Great Depression of the 1930s threatened the very fabric of society. Although the most extreme, the Great Depression was another of the boom and bust cycles that have plagued America's capitalist system from the beginning. Unmitigated speculation produces a bubble of prosperity that inevitably pops. Maynard Keynes, arguably the most influential economist of the 20th century, proposed a method that would dampen the extreme and destructive fluctations of this cycle. Nearly all the nations of the world's have adopted his proposal.

His solution to capitalism's boom-bust economic cycle is straightforward. Employ a social safety net to protect the consumer, who represent the economic health of a nation. This dampens the bottom of the cycle. Fund this with progressive taxation, which also drains money employed for reckless speculation. This dampens the top of the cycle. The US government successfully employed this system to mitigate the extreme economic fluctuations of capitalism's boom-bust economic cycle for over 40 years (1935-1979).

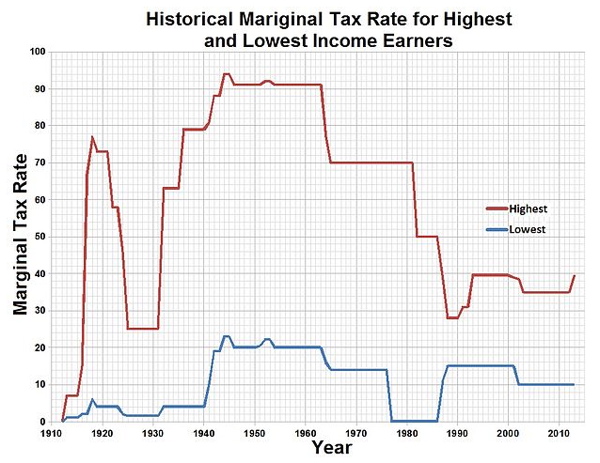

In the 1980s, Ronald Reagan nearly eliminated the progressive nature of our system and shifted the tax burden to the working class. It could be argued that the elimination of progressive taxation was a contributing factor to the Great Recession of 2007. We need to restore progressivity to our tax system for the health of the nation. Tax reform is the solution to our nation's economic woes, not austerity measures.

Introduction

“Taxation is what we pay for civilized society.” Oliver Wendell Holmes

Are taxes really necessary? If they are necessary, should everyone pay the same percentage of their income in taxes? Or should a citizen’s ability to pay taxes be taken into consideration when assessing tax burdens? Should certain citizens be asked to shoulder the lion’s share of the burden? If so, which class of citizens and why?

The Necessity of Government Taxation

We are all in the 'tax burden' boat together. We all imagine that we can spend our cash dollars more wisely than any government. We believe we can target our own personal needs better than some distant local, state or federal legislature. We have a sense that government uses our tax money for more distant, abstract purposes. The immediacy of our wants and needs may lead us to resent the notion of higher taxes.

The poor wage earner might think he could afford some new clothes for his children or perhaps go to the dentist. The wealthy wage earner could imagine the luxuries that he would forgo. Perhaps in some affluent cases, it might even be a new yacht or perhaps the million-dollar Monet painting that would look so good in his living room. Regardless of economic class, both rich and poor are capable of sharing a belief that government taxation somehow unfairly deprives them of valued personal resources.

But government taxation was never designed to meet the idiosyncratic needs and wants of the individual citizen. Rather taxation was meant to provide the means for government to take actions that benefit the citizenry on a scope that individual citizens could not possibly hope to provide by themselves.

We have always expected the federal government to protect our borders from outside aggressors, but over the course of history our expectations for the federal role in public welfare have grown. Today, the federal government, as well as local and state governments, use tax money to provide for fundamental societal functions. Prominent examples of government functions that we have come to take for granted are fire departments, law enforcement agencies, and departments of public health and education. (Note: the private sector, while creating jobs and services, is not expected to provide for these fundamental societal functions.)

Although federal revenue plays an important role in promoting the general welfare of the American people, this does not mean that all tax money is well spent. We can all think of examples where our hard-earned money has been spent on wasteful government policies. Such squandered funds certainly justify greater scrutiny and care in the design of federal programs. However, misspending tax revenues should not prevent us from recognizing the compelling needs that only well spent tax revenues can address.

The infrastructure of America as well as the health and retirement of its citizenry depend upon federal taxation. When we discuss the notions of tax burden and tax relief, we must firmly keep in mind the immense societal concerns that our tax system addresses. It is our duty as citizens to contribute to the social support system that protects the quality of life for individual Americans. This contribution represents a sacrifice made by each taxpayer. A responsible citizen should accept this role because we all benefit from government programs that address social needs that far exceed the capacity of citizens acting on their own behalf.

Balancing Necessities vs. Balancing Luxuries

Given the need for taxation to fund essential government functions, how should the tax burden be assessed on the citizenry? Should all citizens be expected to pay an equal percentage of their income in taxes? Do all tax payments represent the same sort of sacrifice for each individual taxpayer? Does the justice of the tax system somehow depend upon the answer to these questions?

We all experience a sense of loss when we pay our taxes. But the consequences of all losses do not represent equal suffering. Although the actual monetary size of a millionaire’s tax payment is far greater, the consequences of that loss do not represent a significant threat to his or her basic subsistence needs. These individuals still have an enormous amount of after-tax disposable income to purchase the finer things in life. These tax payments, although large, never threaten the fundamental wellbeing of any wealthy citizen.

In contrast, the far smaller payments represented by taxpayers at the lower end of the income ladder do represent potential threats to (and tradeoffs among) basic subsistence needs. Families may have to choose between necessities such as education, clothing, food, medical and energy expenses. Medical and dental procedures are all too often postponed or forgone entirely. These sorts of consequences are threatening to the wellbeing of the typical American citizen.

When we compare the consequences of the losses represented by tax payments, we gain a new perspective on the suffering associated with our obligations as tax paying citizens. Clearly most, if not all, taxpayers suffer a sense of loss when they contemplate the payment of their tax ‘burden’. However, for many of those in the lower and middle income tax brackets, this sense of loss is accompanied by real material suffering. For the wealthy, the tradeoffs are between competing wants, while for many lower income Americans the tradeoffs occur between competing needs.

It may be difficult to remove all bias from this statement, but it is probably true that the notion of personal suffering represented by the term ‘tax burden’ is vastly different depending upon one’s location on the income ladder. The kinds of tradeoffs and losses experienced by taxpayers appear to have far greater negative consequences on moderate and low-income citizens. The suffering associated with the loss of luxury items is hardly comparable to the suffering associated with the material consequences of balancing competing necessities.

Early History: Progressive Tax System to fund War

Please recall the 3 types of taxation we have previously examined – progressive, flat and regressive. The example discussed above provides a clear understanding of the shortcomings of a flat tax on income. It is apparent that while a flat tax does provide an equal tax rate, the consequences suffered by taxpayers are in no way equal. If we are looking for a notion of equality that better represents tax justice, we must look beyond the mathematical equality of a flat income tax.

Clearly, if a flat tax falls short of an acceptable definition of a just tax system, regressive taxes add insult to injury. By requiring those who have the least ability to pay to provide a greater percentage of their income in taxes, we do a disservice to that segment of our society. If we are truly concerned with the conception of a fair tax ‘burden’, we must look in the direction of a progressive tax system.

To better understand the function of progressive taxes, let us examine the history of such taxes. In 1798, the British instituted the first progressive income tax in order to finance the growing Napoleonic Wars. There were 2 tax brackets. Those earning between 60 pounds and 200 pounds annually were required to pay about 1% of their income, while those earning over 200 pounds per year paid 10%. Those making less than 60 pounds paid no income taxes.

Ironically, Prime Minister William Pitt, a wealthy conservative, proposed the British Tax Act of 1798. He initially opposed the tax altogether. But when it became evident that the survival of the nation was at stake, he reluctantly changed his viewpoint on government taxation.

Why not a flat tax? It was obvious to all concerned that a flat tax could not raise sufficient funds to support the war effort. Those on the bottom of the income ladder were struggling to make ends meet and had very little to contribute. Those in the middle didn’t have adequate income to make a significant contribution to the war tax.

Only those at the top of the ladder had sufficient resources to fund the growing need for the munitions, soldiers and training necessary to defend the nation from the growing power of republican France. Further, the British aristocracy perceived a direct threat from the ‘radical’ democratic intent of the French Revolution.

Under these circumstances, progressive taxation was an easy sell to the ruling class. And yet Pitt only raised 60% of his desired goal. The tax expired after the war was over as the danger to the prerogatives of the British aristocracy had passed.

In 1862, the US Congress passed the first progressive tax in American history. It was modeled after the British Tax Act of 1798. This new federal tax was instituted during the American Civil War in order to fund the military effort of the North against the rebellious South. Let us examine the process that led to passage of this landmark legislation.

Realizing that the Union Army needed immediate cash flow if it was to defeat the Confederate Army, US President Abraham Lincoln initially called for a flat tax of 3% on income over $800 – the Revenue Act of 1861. When he realized that a simple flat tax could not raise sufficient funds, his Administration called for 2 new taxes.

One, the Excise Tax, was somewhat equivalent to the Sales Tax, in that it was a consumer-based tax on the sale of common items. This tax had a more severe effect upon those at the bottom of the income ladder. Although a flat tax, it had a regressive effect, just like any other consumer-based tax. In modern times, for example, an Excise Tax is levied upon alcohol and tobacco, items that consume a greater percentage of the disposable income of those earning less.

To balance the obvious regressive effect of the Excise Tax, the Lincoln Administration proposed a second tax – a progressive income tax. This progressive tax had 2 income tax brackets. Those whose annual earnings were between $600 ($14K currently) and $10,000 ($230K currently) were required to pay 3% of their income. Those earning over $10,000 were required to pay 5% of their income. Congress obliged the request and passed the Revenue Act of 1862.

When this funding effort also fell short, the Lincoln Administration passed the Revenue Act of 1864, which increased progressivity in order to raise the needed revenue. The Act added an additional bracket and simultaneously raised the tax rates. No taxes were paid on income less than $600($14K); 5% on earned income between $600 and $5000($116K); 7.5% between $5K and $10K($233K); and 10% on earnings above $10K per annum. These income taxes were withheld at the source, possibly due to collection problems experienced under the initial acts (an early example of payroll withholdings).

Perhaps Lincoln felt that this increase in progressivity should be well received by wealthy Northerners. These affluent citizens had the most to lose if the South successfully seceded from the Union. And these same citizens also had the greatest ‘ability to pay’ for the war effort that would save their country and their southern investments. This well-financed war was won in 1865. By 1873, the first progressive tax in US history had expired.

Over the next two decades, the power of the federal government grew, as did its needs for additional tax revenue. To address this issue, the US passed legislation in 1894 to tax the earnings from rental property, interest, and stocks. Congress had come to view these earnings as personal income and therefore taxable under the Constitution. However, the Supreme Court ruled that rents, interest and dividends were all deemed property income, not earned income as defined by Congress in 1894. As such, the Supreme Court ruled that this law was unconstitutional.

The Constitution allowed the Congress to levy ‘head’ taxes, such as income taxes. However, the Constitution prohibited the Federal Government from levying ‘property taxes’ directly. The only Constitutional way that the Federal Government could levy ‘property taxes’ was through an indirect approach. The states could be required to collect these federal taxes, but they had to be based upon a cumbersome census process. Unfortunately this unwieldy process had the effect of functionally eliminating these ‘property taxes’ as a source of federal income.

To circumvent this stipulation, the United States Government persuaded the state legislatures in 1913 to ratify the 16th Amendment to the US Constitution. This amendment gave Congress the power to tax income, no matter what the source. In other words, Congress could now directly tax income from ‘property’, such as rents, dividends and interest earnings, without going through the states and the prohibitive census process. Again the change in the tax system was instigated due to war – the anticipation of a brewing European war (a conflict that would ultimately result in World War I).

Congress took immediate advantage of the 16th Amendment. They introduced legislation the same year to create the 1st permanent progressive income tax. There were 7 brackets starting at 1% and ending at 7%. The top tax bracket targeted income above $500K ($12M currently). In other words, only the wealthiest members of society were required to pay the highest rate on that portion of their income that exceeded the maximum threshold.

Four years later, in 1917, the US entered World War I. The Government needed more cash flow to finance the war effort. Congress obliged by passing legislation designed to raise more funds. They increased the tax percentages. The bottom bracket was now required to pay 2% of their annual income, while any income over $2M ($37M currently) was taxed at a 60% rate.

Congress also increased the number of tax brackets to 21. With a larger number of brackets, the Government was able to generate greater revenue. The multiplicity of tax brackets also distributed the tax sacrifice more equitably. These newly created brackets established a gradation of tax burdens that more accurately reflected the wide range of American prosperity. On a sliding scale, from the bottom to the top of the income brackets, those with a greater ability to pay taxes were required to contribute the most.

It is unlikely that the progressive tax system would have been ratified without the support of wealthy and powerful Americans. The top income tiers were clearly the ones most likely to benefit from a victorious war effort. The borders of the United States were never directly threatened during World War I. However, an unfavorable outcome to the war threatened American overseas investments as well as the enormous war loans made to Great Britain and France.

We can understand why wealthy Americans were willing to pay a high percentage of their income in federal taxes. Although tax rates would take a bigger bite from the incomes of the wealthy, the benefits of a victory in World War I clearly outweighed their objections. In 1925, several years after the war had ended, the tax percentages on wealthy Americans dropped substantially. Income over $100K ($1M currently) was taxed at a 25% rate, down from 60% in the midst of the war.

Up to this point in history, every progressive tax system was a response to the demands of war. Progressive taxes were necessary to generate sufficient funds to create a powerful military force that had the potential to be victorious. The wealthier segments of society were apparently motivated to pay a higher percentage of their income in exchange for protection of their privileges, investments and power-base.

Keynesian Economics

The underlying motivations for taxation all changed with the Great Depression that began in 1929. A huge percentage of the population, peaking at almost a quarter of the work force, lost their source of income. These individuals had very little money to spend. With the money supply dramatically dwindling, most businesses began cutting back or going under. For instance, in order to continue operating his small dry cleaning business in Kansas, my grandfather had to lay off most of his employees. These layoffs, whether big or small, further weakened the ailing US economy and sent it into a downward spiral that had worldwide ramifications. Political turbulence and the potential collapse of the social structure appeared to be on the horizon.

In the preceding post-War decade of the 1920s, the American economy was booming and now it was bust. A ‘boom & bust’ cycle had been a regular characteristic of the US economy ever since the emergence of capitalism in the 1800s. This pendulum-like cycle consisted of 2 interrelated stages. Speculative investment drove prices and profits up. Ultimately, the speculation-driven growth was unsustainable and the market overheated resulting in economic contraction. Further the ‘boom-bust’ cycles had become more and more extreme. The Great Depression provided dramatic testimony to the increasingly harsh effects associated with the ‘bust’ portion of these economic cycles.

The devastating results of the Great Depression raised some challenging questions. Can we rely on unregulated capitalism to adequately address the harms created by the current dramatic economic downturn? Or does the government have a role to play in combating the excessive fluctuations of free market capitalism? If so, what actions must government take to dampen the ‘boom-bust’ cycle and avoid the effects of an even more severe economic downward swing in the future?

A new economic theory emerged in the 1930s that addressed the extreme behavior of the boom-bust cycle. John Maynard Keynes (1883-1946) of England played a key role in the development of this new perspective. He wrote a highly technical, yet influential, book on economics entitled General Theory of Employment, Interest and Money that came out in 1935. Many academics and policy makers believe this book to be the most important economics book of the 20th century. Indeed, many economists consider this book to be comparable in importance to Adam Smith’s 18th century work, Wealth of Nations.

Keynes’ seminal book stressed the importance of the consumer. He reasoned that the consumer is the foundation of capitalism. Without a customer, there is no business. Many emerging successful businesses were tapping into the growing prosperity of the working class. For example, Ford Motor Company, Wrigley Chewing Gum and Bank of America had grown rich by targeting the surplus assets of those on the moderate and lower rungs of the economic ladder.

In a ‘bust’ cycle, this segment of society loses the income to purchase goods due to loss of employment. The lack of a viable market negatively affects the profits of nearly all business owners. Once the growth bubble bursts, businesses typically respond to reductions in profits by reducing their workforce. Increases in unemployment further undermine consumer-purchasing power, which further reduces profits. This downward cycle of economic contraction became more extreme as the economy became more dependent on the consumer spending of the working class. This line of reasoning led Keynes to the realization that a large consumer base was of ultimate importance to the business community.

Prior to Keynes, most economic and political leaders embraced a laissez-faire approach to capitalism. There was a strong faith that the laws of supply and demand would ‘naturally’ regulate the economy better than government intervention. Government action was inherently distrusted and a ‘hands off’ philosophy was the standard viewpoint. Keynes began to question the notion that the best policy was necessarily ‘hands off’.

The question facing Keynes became: What sort of actions would assist the citizenry to continue spending money during an economic downturn? It was evident that ‘free market’ capitalism of the private sector, although driven by consumer spending, was unable to protect its own consumer base. Keynes theorized that the public sector had to step in to cushion the all-important consumer during times of economic hardship. Keynes argued that governments needed to take protective actions in an effort to maintain full employment for the good of the overall economy.

Keynes approach was in significant contrast to the ‘hands off’ laissez faire approach to fiscal policy that was in vogue at the time. He proposed a range of methods for government to intervene in the marketplace, including adjusting interest rates and deficit spending. If the problems were not too severe, government could act to lower interest rates. This lending stimulus would presumably provide enough encouragement for business to preserve and/or create jobs.

However, some economic problems were so intransigent that simply adjusting interest rates would not be sufficient. In an extreme case, for instance the Great Depression, the strategy would require the government to run a deficit in order to protect consumer spending. Government borrowing during such a crisis could be critical to adequately funding a ‘social safety net’, protecting government jobs, and in creating new jobs as the employer of last resort.

Keynes’ strategy for government action seems counter-intuitive to those who think that a government budget should behave like a personal budget. When an individual experiences a reduction in income, the typical response is to reduce personal spending. During times of recession, government also experiences a reduction in income as earnings decline and unemployment grows. A typical, if not natural, response to a reduction in tax revenue is to tighten the budget by curbing government spending. Keynes analysis suggests this ‘belt-tightening’ strategy actually undermined economic recovery by cutting government spending at the worst possible time.

The ideas in Keynes’ book were so influential that they transformed the economic policies of virtually all the nations of Western civilization. Due to their importance, this economic strategy is referred to as Keynesian economics. Although the solutions have been refined in recent times, as we shall see, adjusting interest rates and deficit spending are key tools in economic strategy 80 years later. His concepts regarding the importance of full employment and the health of consumer spending continue to successfully inform government policies to this day.

Progressive Taxes to temper Boom & Bust Cycle

In 1932 Franklin Delano Roosevelt was elected president and immediately confronted the daunting effects of the Great Depression. Instead of following the ‘hands off’ tenet of laissez capitalism that had proved so unsuccessful for the prior Hoover and Coolidge Administrations, his Administration explored a Keynesian approach to these intractable economic problems. To address unparalleled levels of unemployment and to bolster the purchasing power of the consumer base, FDR increased the federal government’s role in order to protect the economic health of the nation.

The US Government took aim at two classes of citizens: workers and retired people. To protect the working class, Congress passed disability insurance legislation to assist those workers who lost their jobs due to illness or injury. Legislation was also enacted to provide unemployment insurance to those who suffered job loss for reasons other than disability. For those workers who had retired from the work force, Congress also created the Social Security System. These government programs supported the wellbeing of workers and retirees, and thus enabled them to more effectively funnel money back into the system. Although relatively small, this government assistance enhanced the purchasing power of both classes of consumers, even if at a reduced rate.

This government action lessened the extremity of the downward economic cycle and consequently helped keep the economy afloat. If government action can help soften the bottom of the boom-bust cycle, could it also provide a dampening effect upon the over-heated speculation at the top of the cycle? If government programs can help moderate the extreme swings of capitalist economies, how were the proposed social programs to be funded? Fortunately, the same solution answers each of these questions – progressive income taxes.

In times of war, governments have an extreme need for revenue in order to sustain an effective military effort. Several times in recent history, democratic governments have found that the progressive income tax was the key to raising sufficient funds for the war effort. The Napoleonic Wars, the American Civil War and World War I are all examples of Western democracies turning to progressive taxation in times of great crisis.

By focusing the tax burden on those with the greatest ability to pay, progressive taxation was able to rapidly generate an enormous amount of revenue. This pragmatic approach recognized that the working class lacked adequate taxable resources. Further, it acknowledged that the wealthier sectors of society stood to benefit the most from a successful war effort.

In the case of the Great Depression, the crisis was economic not military. But the solution was the same. Keynes argued that this sort of dramatic economic downturn could only be moderated by government actions. Some of these actions would require government spending in order to counteract the downward spiral. Clearly government could not tax those who were suffering most from the Great Depression in order to fund the social safety net. The proposed government obligations required progressive taxation with its attendant method of targeting those with the ‘greatest ability to pay’.

For Keynes, the health of consumer spending was (and is) at the heart of a successful capitalist economy. The health of the economy cannot depend entirely upon the well being of the wealthy class. Progressive taxation draws funds from those with a greater ability to pay in order to bolster consumer spending among those on the lower rungs of the income ladder. By enhancing consumer spending, business profits and investment income will also ultimately grow.

Although taxes redistribute money from the top of the income ladder to the bottom, it comes back to the top in terms of increased business profits. The wealthy that are truly job creators benefit from an increased consumer base, which is best funded by progressive taxes. This approach is a win-win scenario for society.

Progressive taxation also has a counter-cyclical effect that dampens the extreme effects of the ‘boom-bust’ cycle. As profits grow during a boom cycle, taxes on the upper brackets also experience significant growth. The effect of this approach to taxation is that fewer assets are available for speculation. With comparatively less capital available, wealthy speculators are less capable of driving a boom phase to unsustainable levels.

With less money available for speculation and more money available to spend on goods and services, the boom-bust cycle is less likely to become turbulent and drive the economy into depression. By funding a larger consumer base and draining funds employed for hyper-speculation, progressive taxation effectively moderates both the bottom and top of the economic wave. This proactive approach attempts to supplant the volatile boom-bust cycle by promoting stable economic growth.

With these considerations in mind, the Roosevelt Administration passed legislation in 1932 that increased both the percentages on taxable income and the number of tax brackets. The bottom bracket began at 4%, while the top tax bracket, which only applied to annual income over $1 million dollars ($17M inflation adjusted), was 63%. In other words, only the wealthiest members of society, those most able to pay, had the top portion of their income taxed at the highest rate. To spread the sacrifice of the tax contribution more equitably across the economic spectrum, 55 tax brackets were created.

In 1936, tax legislation increased the tax percentages on the top earners and reduced the number of tax brackets to ‘only’ 31. However, to ease the tax burden on those in the middle of the income ladder, the brackets were spread out. For example, only income over $5 million ($84M modern equivalent) was taxed at the highest rate of 79%. In this fashion, the extremely wealthy paid a substantially higher percentage of their income than the moderately wealthy or the middle class wage earner. (Remember that due to the graduated nature of the tax brackets, the wealthy only paid this high percentage on income exceeding $5 million, not on their entire income.)

Progressive Taxation with Integrity (1946-1979)

Following on the tail of America’s economic crisis came a second world war. Again the US Government needed additional funds to finance the war. In time-honored fashion, they employed the progressive tax system to fund the escalating needs of the military.

The tax percentage for the bottom income bracket reached 2 digits for the first time. To raise an ever-increasing amount of funds as the war intensified, the percentage rate of this lowest tax bracket was raised from 4% to 10% in 1941, then to 19% in 1942, and then 23% in 1944 at the peak of the war. Simultaneously, the percentage rate of the top income bracket rose from 79% to 81%, then to 88%, and finally reached a peak of 94% in 1944.

At first, the top percentage only applied to income over $5 million per annum ($80M currently). In other words, only the tremendously wealthy paid this tax rate and only on that portion that exceeded the $5 million threshold. After the US entry in World War II, the income threshold of the top tax rate was lowered significantly to apply to income over $200K ($3M currently). Reiterating for emphasis, only income above this level was taxed at the top rate. Income below this threshold was taxed at the same rate as those with smaller incomes.

In 1946 after the conclusion of World War II, the tax percentages were reduced, but only slightly. The bottom rate was reduced from 23% to 20%, the top rate from 94% to 91%. Both the number and the income thresholds of the tax brackets remained the same.

Because this tax structure remained unchanged for an unprecedented 18 years (from 1946 to 1964), it would be instructive to examine the details of its organization, as shown in the following table.

1954 Tax Brackets |

Effective |

Disposable |

||

Income Level |

Tax Rate |

2008 Equivalent |

Tax Rate |

Income |

Up to $2K |

20% |

Up to $37K |

20% |

$30K |

$2K -> $4K |

22% |

$37K->$75K |

21% |

$59K |

$4K -> $6K |

26% |

$75K->$112K |

23% |

$87K |

$6K -> $8K |

30% |

$112K->$150K |

25% |

$113K |

$8K -> $10K |

34% |

$150K->$187K |

26% |

$138K |

$10K -> $12K |

38% |

$187K->$225K |

28% |

$161K |

$12K -> $14K |

43% |

$225K->$262K |

30% |

$183K |

$14K -> $16K |

47% |

$262K->$300K |

33% |

$202K |

$16K -> $18K |

50% |

$300K->$337K |

34% |

$221K |

$18K -> $20K |

53% |

$337K->$375K |

36% |

$239K |

$20K -> $22K |

56% |

$375K->$412K |

38% |

$255K |

$22K -> $26K |

59% |

$412K->$487K |

41% |

$286K |

$26K -> $32K |

62% |

$487K->$600K |

45% |

$329K |

$32K -> $38K |

65% |

$600K->$712K |

48% |

$368K |

$38K -> $44K |

69% |

$712K->$825K |

51% |

$403K |

$44K -> $50K |

72% |

$825K->$937K |

54% |

$435K |

$50K -> $60K |

75% |

$937K->$1.1M |

57% |

$482K |

$60K -> $70K |

78% |

$1.1M->$1.3M |

60% |

$523K |

$70K -> $80K |

81% |

$1.3M->$1.5M |

63% |

$558K |

$80K -> $90K |

84% |

$1.5M->$1.7M |

65% |

$588K |

$90K -> $100K |

87% |

$1.7M->$1.9M |

67% |

$613K |

$100K -> $150K |

89% |

$1.9M->$2.8M |

75% |

$716K |

$150K -> $200K |

90% |

$2.8M->$3.7M |

78% |

$810K |

$200K -> |

91% |

$3.7M or more |

82% |

$922K |

The transparency of the organization is striking. The tax structure seems to be designed to spread the tax burden equitably over a broad income spectrum. The first 11 brackets consist of income increments of $2K, then $4K followed by 4 increments of $6K, then 5 at $10K, then 2 at $50K. There is a consistency in how the tax percentages are applied to each income bracket. Most of the percentage increases are either 3% or 4% from bracket to bracket. Only at the very top and bottom does the percentage rise only 1% or 2%. How orderly, how just. Each step up the income bracket ladder reasonably requests the citizenry to pay a little bit more of their additional prosperity in taxes for the general welfare.

Note in the preceding table that the effective tax rate tends to be 10% to 20% lower than the stated rate for each individual bracket. The effective rate is lower because the income earned in each graduated tax bracket is taxed at the specific rate assigned to that particular bracket. The effective tax rate reflects what individuals actually pay on their entire taxable income.

For instance, someone earning $10K in 1954 would pay 20% on the first $2K of taxable income, then 22% of the next $2K of income, 26% on the next $2K, 30% on the next $2K, and 34% on earned income between $8K and $10K. Although this process appears complicated, a simple table calculates an individual’s tax responsibility, which reflects the effective tax rate – 26% in this case, as displayed in the preceding table.

Even though the tax percentages are high, the disposable income for those in the highest tax brackets is still enormous. The disposable income column in the preceding table demonstrates the amount of money a citizen would have available to spend after paying federal income taxes. A citizen earning $200K in 1954 paid an effective rate of 78%. In 2008 dollars, this same individual would be earning the equivalent of $3.7 million, and, if taxed at the same 78% effective rate, would still have over $800K left in disposable income.

In 1964 and 1965 during the Johnson Administration, the tax percentages were reduced substantially for all tax brackets. The upper tax brackets received special consideration. The bottom bracket dropped a few percentage points from 20% to 16% and then to 14%. The top bracket ultimately dropped 21%: from 91% to 77% to 70%. This tax system remained in place for another 16 years utilizing over 20 tax brackets with the top bracket taxed at a 70% rate.

From 1932 to 1981, almost half a century, there were over 20 graduated tax brackets to spread the tax burden relatively equitably across the entire income spectrum. During this period, the percentage on the top tax bracket was 63% or more. Only the very wealthy paid this top percentage. This rate only applied to that portion of annual income that exceeded an amount that would be currently valued at a million dollars. The tax code during this half-century faithfully incorporated the ‘ability to pay’ – one principle that is at the heart of progressive taxation.

Then came the Reagan era.

Milton Friedman (1912-2006): Negative Income Tax

In the 1960s, a prominent economist began questioning some of the Keynesian theories that had driven government policy for the previous quarter century. His name was Milton Friedman. Friedman was a leading member of the Chicago school of economics and its most well known member. He is considered to be second in importance to Keynes in terms of political influence in the 20th century. While Keynes laid the foundations for the middle of the century, Friedman’s refinements dominated government policy during the final quarter of the century.

Friedman was in agreement with Keynes on many key issues. In similar fashion to Keynes, Friedman believed that controlling interest rates was a valuable tool in tempering the fluctuations of the business cycle. Both viewed raising interest rates as an important method for combating inflation. A hike in interest rates typically would slow business activity and reduce inflationary pressure. Conversely, lowering interest rates was viewed as a method to stimulate business investment.

Like Keynes, Friedman respected the importance of the consumer as the key to a healthy economy. However as a laissez faire economist, Friedman rejected what he called ‘naïve Keynesian economics’. For instance, in contrast to Keynes, Friedman’s theory held that full employment was impossible. According to his economic philosophy, there is a ‘natural’ unemployment rate (somewhere in the single digits). Government action that attempted to reduce it beyond this ‘natural’ threshold would only aggravate unemployment and imbalance the economy. Virtually no government questions this analysis in current times. It seems that unemployment is a necessary feature of a capitalist system, and in this sense Keynes was unrealistic or naïve.

While Keynes may have been unrealistic about the goal of zero unemployment, governments continue to utilize many of his other central economic principles to this day. Friedman’s critique of Keynes addresses some of these contemporary economic policies. While Keynes relied on government programs to play a significant role in protecting consumer demand, Friedman felt this could be accomplished by reducing government’s active role. This included the deregulation of business and the elimination of social programs for the needy.

Adhering to the fundamental Keynesian notion that the consumer was the key to a strong economy, Friedman advocated an approach that replaced the expanding role of federal government programs with a negative income tax. A negative income tax is another name for a guaranteed annual income. Rather than relying on specific federal programs, Friedman theorized that every citizen should at least be guaranteed a predetermined minimum income. If a citizen’s income fell below a certain threshold, the government should fund the difference with revenues raised from a progressive tax system.

While Keynes advocated government intervention through specific programs to assist the less fortunate, Friedman advocated direct, automatic funding. Friedman’s preset, almost mechanical, system would eliminate the centralized, bureaucratized social welfare services. Providing a guaranteed minimum income to every citizen could be a more efficient way to support consumer spending without creating social programs supported by burgeoning government bureaucracies.

Both Keynes and Friedman believed in the importance of employment to consumer spending. Keynes theorized that the public sector should supplement the private sector by providing jobs for the able-bodied that would otherwise be unemployed. Friedman’s analysis suggested that the private sector would accomplish the same task more efficiently.

As a monetarist, Friedman argued that it was not government policy that drove the business cycle, but rather the previously mentioned interest rate adjustments combined with a new appreciation for the importance of money supply. Rather than creating public jobs, government should increase the money supply available to banks. The banks can then lend this money to the private business community in order to create jobs.

Many economic conservatives misinterpret Friedman’s position as a return to a pure form of laissez faire capitalism. Neither Friedman nor Keynes trusted the free market to be able to resolve major economic fluctuations on its own. Both agreed that the government needed to act as an intermediary between free market capitalism and the welfare of the citizenry. Both argued that the government would need to make interest rate adjustments. Friedman went further to suggest that the government should also act to adjust the money supply.

Friedman is also often misunderstood as an economist who advocated eliminating government support for the financially challenged members of US society. While Keynes argued for the creation of government programs that targeted groups of needy citizens, Friedman argued for a different type of government action. Friedman’s ‘negative income tax’ was designed to enable these challenged individuals to remain actively consuming, even if at a reduced rate. Friedman wanted to replace government bureaucracy with automatic payments, not eliminate social assistance to the needy.

Friedman understood that his negative income tax approach required federal funding. His solution called for the utilization of progressive taxation. He realized, as did Presidents Lincoln, Wilson, and Roosevelt, that only the upper income brackets possessed adequate resources to meet these challenging economic needs. In this sense, Friedman believed in progressive taxation as a means of redistributing wealth from higher to lower income individuals in order to protect the consumer base and thereby the overall American economy.

It would be wrong to characterize Friedman as opposing a government role in combating the excesses of laissez faire capitalism. It would also be inaccurate to portray him as a foe of government assistance in support of an endangered consumer base. And finally it would be disingenuous to somehow claim that Friedman was an enemy of pre-Reagan Era progressive taxation. And yet conservative economists often misconstrue Friedman’s philosophy to take the opposite of these 3 well-documented positions.

According to Friedman’s analysis, Keynesian economics worked perfectly during times of growth and inflation. This was the global situation for almost 40 years, from the end of World War II until the 1970s. However, he predicted that Keynesian economics would be unsuccessful during a time of inflation combined with recession. Lending credence to Friedman’s theories, the nation entered such a period, shortly after he became a Nobel Laureate in 1976.

Modern History: Reaganomics guts Progressivity of US Tax System

Stagflation

In the late 1970s, the global economy entered a period deemed ‘stagflation’. Even though the economy was ‘stagnant’ with high unemployment rates, inflation was raging out of control. Both were in double digits. Typically high unemployment is not accompanied by high inflation rates. What led to this unusual state of affairs? And what effect did this state of affairs have on government economic policy?

The Middle Eastern oil producers joined together to form a cartel, known to the world as OPEC. The ultimate effects of this cartel led to (at one time) politically motivated oil embargos on Western Europe and the United States, and in general dramatically increased global petroleum prices. For instance, the price of gasoline tripled from 33 cents to over a dollar per gallon between 1973 and 1974.

The tripling of energy costs had an adverse effect upon the price structure of an essentially petroleum-based economy. The dramatic increase in cost of energy led to a corresponding increase in the prices of nearly all basic commodities, including food. With the price of necessities skyrocketing, many workers demanded and were granted raises, which further aggravated inflation rates. Unable to handle the economic stress of increasing energy and labor costs, many businesses went under, which led to unacceptably high unemployment rates.

As Friedman predicted, the Keynesian approach seemed unable to deal with this unique economic situation. Neither adjusting interest rates nor increasing government spending seemed to be feasible options for policy makers given the simultaneous threats of inflation and unemployment. Events appeared to call for a different economic theory.

As a consequence, the theories of Friedman’s monetarist school came to be given increased consideration. Monetarists argued that government could address the stagnation of rising unemployment by increasing the money supply, rather than increasing direct government spending. Providing additional funds to the private sector would enable the economy to right itself naturally without risking the perceived inflationary pressures associated with the expansion of government programs. Due to the purported success of this approach in dealing with the unique problem of stagflation, the importance of monetary policy began to rise as a dominant economic theory.

Shift in attitude towards Progressive Taxes

These stressful times primed the pump for new types of solutions. Further it had been nearly a half-century since the Great Depression. Most had forgotten the original intent of progressive taxation, i.e. to mitigate the disastrous extremes of the ‘boom & bust’ cycle. These taxes came to be viewed in a different light.

During the Depression Era, the ‘social safety net’ consisted primarily of limited assistance for the retired and those who had lost their jobs. In the ensuing decades, the social safety net expanded considerably to include a wide range of government assistance for the needy, including but not limited to education and medical needs. Each of these programs had the effect of transferring government funds that consisted primarily of taxes from those on the top of the income ladder to those on the bottom or middle of the income ladder.

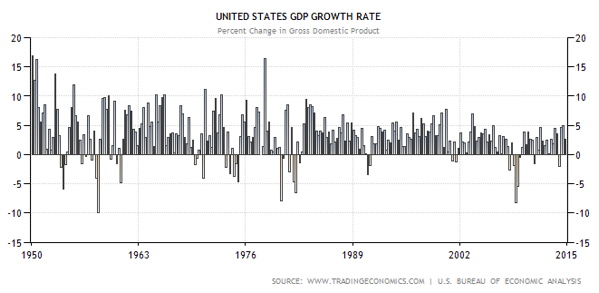

Recall that this redistribution of wealth was at least in part devised to protect Americans from the devastating economic consequences of capitalism’s innate boom-bust cycle. Funding the social safety net via progressive taxation provided funds to create a stronger consumer base that is the foundation of modern capitalism. Further, this form of taxation had the added benefit of constraining funds employed for reckless speculation. While compassion may have played a part, this taxation strategy was devised primarily to prevent serious threats to the social structure due to the increasing severity of global economic oscillations. As evidence for the success of this unique counter-cyclical strategy, the United States never returned to an economic downturn the magnitude of the Great Depression during the subsequent half-century.

Maintaining socio-economic stability was the initial motive behind the creation of the progressive tax system in the 1930s. By 1980, nearly a half-century after the Great Depression, the urgency of the original purpose appears to have been forgotten. The redistribution of wealth was rarely viewed as a financial strategy designed to benefit the entire economic spectrum. Instead government assistance for lower income Americans was increasingly framed as ‘socialist handouts’ funded by excessive taxes on ‘job-creating capitalists’. In other words, the public understanding of the motive behind progressive taxation underwent a perceptual shift from economic stability to altruistic liberalism.

The altruistic interpretation of progressive taxation, whether inadvertent or intentional, led to a not so subtle shift in the values that citizens began to associate with their tax payment. The concern for the general economic welfare that flowed from the experience of the Great Depression was replaced by a concern for the negative impact of taxation upon the individual, the family, and the recipient of governmental aid. It became popular to characterize social assistance as a set of counter-productive measures that actually fostered an unhealthy dependence on government at the expense of self-reliance. This new perspective led to broad-based taxpayer resentment and a corresponding disrespect for the value of a social safety net.

Cries of outrage were heard from all income levels, including the lowest. Common sentiments include(d): “Why should my hard earned money go to taxes that fund a bloated welfare state that takes care of the undeserving?” “Why should workers be asked to provide financial assistance to jobless members of society?” “How is government assistance ever going to result in self-sufficient productive citizens?” Under this mindset, compassion for the needy came to be perceived as a personal sacrifice demanded of the taxpayer, which could be likened to liberalism’s ‘soft love’ that risked spoiling the child.

After hearing this refrain played in myriad variations, a majority of the population came to resent what was and is perceived as ‘excessive taxation’. Under this media barrage, the bulk of the population, inadvertently or intentionally, forgot the original value of the ‘social safety net’ funded by progressive taxation. Conveniently forgotten was the economic wisdom of both protecting the spending power of a broad consumer base and draining off funds employed for reckless speculation.

Reaganomics

Like symphony masters, the Republican Party played this rising emotional sentiment against taxes and government ‘handouts’ to persuade the American public to elect Ronald Reagan US president in 1980. One of his major platforms was, of course, tax reform. The Reagan Administration employed Friedman’s economic theories to add academic credence to their fiscal policy. This new approach became known as Reaganomics.

However as we shall see, they were selective in implementing Friedman’s economic philosophy. They chose to follow policies that primarily benefited those with higher incomes. Reaganomics appeared to ignore, or even chose to directly violate, the parts of Friedman’s theories that protected the spending power of lower income Americans.

More specifically, the Reagan/Bush administrations implemented a feature of Friedman’s economic philosophy that called for a reduction in government social programs. These programs, which were designed to assist lower and middle income Americans, were to be replaced in Friedman’s approach by a negative income tax funded by progressive taxation. The Reagan/Bush administrations ignored this important substitute support system for vulnerable Americans, while using Milton Friedman’s theory to enhance the economic credibility of Reaganomics.

Reaganomics also appeared to ignore or even violate Freidman’s principles regarding the importance of progressive taxation. Once elected, the Reagan Administration went right to work eroding the progressivity of the Federal tax system and continued right up until the end of his term. Congress passed legislation in 1981, 1982, 1987 and 1988, that successively reduced the progressivity of the tax system. Let’s examine this erosion in more detail.

1980-1988: Erosion of Progressive Taxation

The attack was multi-pronged. Tax legislation reduced the rate on the top bracket in a series of stages from 70% to 28% in only 8 years. During the same period, the rate for the bottom bracket rose from 14% to 15%. The tax liability of those who were most able to pay was reduced substantially, while taxes increased for those least able to pay.

They also eroded the progressivity of the tax system by reducing the number of evenly graduated tax brackets from 25 in 1980 to an astounding 2 by 1988. Simultaneously, the threshold of the top tax bracket was reduced from $212K (current equivalent $550K) to $30K ($60K currently). These reductions had a number of significant consequences.

By 1988 the lower middle class wage earner was paying basically the same tax percentage on his income as the multi-millionaire or even billionaire. When those with moderate incomes were required to pay the same tax rate as the extremely wealthy, the traditional standard of ‘ability to pay’ was forsaken. The creation of a Federal Income Tax System presupposed a progressive set of tax brackets designed to spread the tax burden in a just and efficacious manner.

In fact, from 1917 to 1979, the Federal Income Tax had a minimum of 21 brackets with the threshold of the top bracket set at a minimum of one million in current dollars. Traditionally, the top tax brackets were reserved for those citizens who could reasonably be viewed as very wealthy. The history of the Federal Income Tax demonstrates that our conception of tax justice was clearly connected to a set of evenly graduated brackets that reflected a citizen’s ‘ability to pay’. It was accepted for over 60 years that greater wealth indicated a greater ability and hence a greater duty to shoulder a fair share of our society’s tax obligations.

By reducing overall tax rates as well as the number and thresholds of tax brackets, the Reagan Administration successfully eliminated the progressivity of the US tax system. Progressive taxation was replaced with an essentially flat tax for all but those on the lowest rungs of the income ladder.

Adding to this assault on progressivity, the Reagan Administration nearly doubled the percentages of the regressive Social Security Tax, which is primarily levied on working class Americans. (For more details, check out the article ‘Are US Taxes really Progressive?’.) The percentage of income paid to Social Security rose from 8.08% in 1980 to 15.3% in 1991. (This percentage includes employee and employer contributions.)

This doubling of Social Security Taxes increased an already regressive system by targeting those workers with the least disposable income and consequently the least ability to pay income taxes. The Reagan Administration effectively shifted a substantial portion of the total tax responsibility from higher income to lower income Americans. In essence, Reaganomics can be viewed as series of actions that resulted in a dramatic redistribution of wealth from our poorest to our richest citizens.

The official reason given by the Reagan Administration for this increase in Social Security tax rates was to save the System from default in the near future. The Media faithfully relayed this justification to the US public. An unspoken, yet obviously pragmatic, reason was the need to generate more tax revenue. Reagan’s ‘tax reform’, while leading to huge tax cuts for the wealthiest Americans, also led to a dramatic shortfall in government revenues. The Reagan Era’s increase in Social Security Taxes was employed in part to compensate for this shortfall in income tax revenues.

By the end of Reagan’s term in office, the progressivity of the US tax system was almost non-existent. The unprecedented reduction in tax rates, particularly for upper income Americans, and the near elimination of all tax brackets severely eroded the progressivity of Federal Income Taxes. Further, an increase in the personal income tax rate and a doubling in the Social Security taxes for most wage-earning Americans increased the overall regressivity of the federal tax system.

Consequences: from Bush Sr. to Obama

Unfortunately, the Reagan and Bush Administrations implemented only one half of Friedman’s solution and violated the other. They deregulated business and slashed government programs. However, they failed to implement a guaranteed annual income that Friedman recommended to compensate for such a severe reduction in federal social programs. In addition, they undermined the progressivity of the tax system, which was intended to fund the federal budget including his proposed negative income tax. This strategy was, in effect, a direct violation of Friedman’s theories.

The strategy employed by the Reagan Administration unbalanced Friedman’s equation. As might be expected, this imbalance led to fairly immediate problems. Due in part to the reduction in tax revenue, the social safety net was eroded. This erosion had a negative impact on the foundation of capitalism – the consumer. Plus, it diminished the ability of the government to generate revenue.

Suffocating for lack of funds, George Bush, Reagan’s successor, reintroduced a bit of progressivity to the system. The Bush Administration introduced a 3rd tax bracket, reorganized the tax bracket thresholds, and raised the tax percentages slightly. Earnings over $82K ($140K currently) were now taxed at a 31% rate. While up from the 28% on income over $30K ($60K currently), it was a far cry from the 70% on income over $212K ($550K currently) that had been levied just a decade prior. It is no wonder that many wealthy Americans recall the Reagan and Bush era in a very favorable light.

But the Bush Administration’s adjustments were too little, too late. The nation entered a serious recession. In 1993, Bill Clinton was elected President in part to solve the problems created by the preceding Republican administrations. To address the revenue shortfall, his Administration slightly raised the level of progressivity in the US tax system. The number of brackets were increased from 3 to 5; the corresponding thresholds were distributed more equitably; and the top tax percentages were increased. Income over $250K ($410K currently) up from $82K ($140K currently) was now taxed at a 39.6% rate (previously 31%). The spreading eased the tax burden on lower income Americans and increased the tax contribution from the wealthier segments of society.

The following Republican Administration under Bush II eroded the progressivity of the federal tax system once again. They voted to lower the tax rate for both wealthier Americans and for the poorer segments of society. The bottom rate was reduced to 10% from 15% and the top rate was reduced to 35% from 39.6%. Although all taxpayers received some sort of rate reduction, wealthier Americans benefitted disproportionately due to the dramatic increase in their disposable income.

At the end of the Bush Administration in 2007-2008, the world entered a downward economic spiral. Few would doubt that the Great Recession was due to out-of-control, unregulated speculation by the wealthier segments of society. Speculation created an unsustainable boom during the early part of the decade. The ‘bust’ part of the cycle was so severe that entire countries were driven into bankruptcy. Recall that the nation never experienced an economic downturn of this magnitude during the half of the 20th century that featured a highly progressive federal tax system.

Was this economic disaster an historical anomaly due to unusual economic circumstances? Or did standard economic models predict this global catastrophe? Both Keynes and Friedman did indeed foresee that the American economy would risk substantial recession when government forgets about the ultimate importance of a healthy consuming public.

The conservative economic plan that followed the Reaganomics model was ostensibly designed to ‘reform and simplify’ the tax system. In actuality, this approach to ‘tax reform’ actually undermined the economic health of the both Keynes’ and Friedman’s all-important consumer. Minimizing the progressivity of the American tax system freed funds for reckless speculation that fueled a preventable economic meltdown. Further the reduction in progressivity clearly resulted in dramatically diminished tax revenues, which led to a frayed social safety net and rising national debt.

Ultimately, President Obama employed Friedman’s monetary policy to pull the world economy out of its 2007-08 financial nosedive. Instead of creating myriad social programs, Obama merely provided the banking system with an enormous amount of money to generate cash flow. Some liberal economists criticize President Obama for single-mindedly implementing Friedman’s approach to money supply. They faulted his Administration for ignoring Keynes’ call for government programs designed to put Americans back to work rebuilding the national infrastructure. In so doing, the economic recovery has been uneven at best. Investment bankers and Big Business have recovered very nicely from the last recession, while the American working class has seen far more mixed results.

In his second term in office, the Obama Administration reintroduced a modicum of progressivity back into the US tax system. Legislation entitled the American Taxpayer Relief Act of 2012 raised the number of tax brackets to 7 and allowed the top tax percentage to return to 39.6%, the Clinton era tax percentage.

This is the current tax structure. It is still a far cry from the 24 tax brackets of the 40s, 50s, 60s and 70s with the top tax rate of 70% applied only to annual income over one million dollars. However, the current situation is far more progressive than the Reagan Administration with 2 tax brackets and a top tax rate of 28% applied to income over $60K.

A Call to restore Progressivity to the US Tax System

The Obama Administration’s response to the deep economic recession of the Bush Era relied on the economic wisdom of every administration that preceded the Reagan tax revolution. Every presidency since 1933, other than the Reagan/Bush terms, embraced a progressive approach to federal income taxation. For instance, the Roosevelt, Truman, Eisenhower and Kennedy Administrations utilized a notion of progressivity that distributed taxes relatively evenly over a minimum of 24 brackets. All of these administrations agreed that it was reasonable to establish the threshold for the top bracket at would currently be 1 million US dollars. Further, they all agreed to tax the income that exceeded this threshold at roughly an 80% rate.

An extremely progressive approach was a key component of America’s economic health during this period. This half-century presented several dramatic challenges, including both the long recovery from the Great Depression and the costs of the US military effort during WWII. Progressive taxation was also instrumental in our post war economic recovery and was also a prominent feature of the robust economic growth of the Eisenhower/Kennedy years. These 40 consecutive years of progressive taxation produced record levels of economic growth. It is this empirical knowledge that informed the Obama Administration when they decided to increase progressive taxation.

Rebuttal to notion that increased progressivity erodes job creation

A more progressive federal tax system is often opposed on the grounds that increased taxes on wealthy Americans will somehow undermine investments that would result in job creation or expansion. The history of the American economy from 1932 to 1980 empirically demonstrates that high tax rates on wealthier citizens coincided with a period of enormous economic growth. Clearly, substantially higher tax rates did not preclude an unparalleled period of job creation in American history. Therefore, opposition to progressive taxation based upon the fear of a reduction in job producing investments is historically unfounded.

Without a return to a more progressive tax system, the gap between the rich and poor in America is destined to grow. This growing disparity threatens the future health of our economy. A spokesperson for Standard & Poor Financial Services and the head of the Federal Reserve Board have both warned that increasing income disparity threatens the economic recovery. A 2014 analysis by S&P’s rating agency suggests that: “the widening gap between the wealthiest Americans and everyone else has made the economy more prone to boom-bust cycles and slowed the 5-year-old recovery from the recession.” Due to this finding, the prestigious S&P reduced the rate at which they estimated the US economy would grow over the next 5 years.

Federal Reserve Chairman Janet Yellen recognizes the danger of this growing income gap and suggests government action to address it. “Government policies can help reduce the [income] gap through spending on social safety net programs and education, which help increase economic mobility.” An improved government safety net will certainly soften the impact of the dangerous boom-bust cycle. Improved educational opportunities will certainly enhance the ‘economic mobility’ of the lower economic classes. Yet these two types of government programs by themselves cannot solve the growing income disparity. As both Keynes and Friedman would agree, a high degree of progressive taxation must be part of any sensible approach to addressing dangerous income gaps.

This difference between the rate of economic progress at the top and bottom is really at the heart of the growing income disparity. Regardless of how effectively the programs suggested by Yellen may be, they do not address this accelerating rate. As previously mentioned, progressive taxation effectively addresses this accelerating rate of growth by reallocating funds to government programs that benefit far larger percentages of the population.

Not only does this strategy mitigate the boom-bust cycle by draining off funds employed for potentially reckless speculation, but it also protects the purchasing power of lower and middle-income individuals. Recall that these individuals are the ones most vulnerable to economic down turns. It is also the spending of these individuals that is critical to any meaningful recovery when the economy enters the ‘bust’ part of the cycle.

A Proposal to increase the Progressivity of the US Tax System

Increasing the progressive nature of our tax system need not affect wage earners in the bottom half of the income ladder at all. In fact, their tax contribution could be reduced without reducing federal income. The method is simple. Return to tried and true precedents. Create more tax brackets and spread them out with the design of tapping into the funds of those at the top of the income ladder. Recall that these funds are surplus in the sense that they are not employed for basic necessities. Indeed these funds are potentially harmful in that they can fuel unbridled speculation, which intensifies the dangerous boom-bust cycle.

The following table represents a theoretical progressive tax structure that reduces the tax contribution of everyone except those earning over a million dollars a year. Those in the top income brackets would not even notice the reduction in take-home pay. Further under this plan, the impact on government revenues could be negligible.

2014 Tax Brackets |

Proposed Tax Brackets |

||

10% |

0>$9K |

0% |

0>$10K |

15% |

$9K>$36K |

5% |

$10K>$20K |

25% |

$36K>$89K |

10% |

$20K>$40K |

28% |

$89K>$186K |

15% |

$40K>$60K |

33% |

$186K>$405K |

20% |

$60K>$80K |

35% |

$405K>$407K |

25% |

$80K>$100K |

40% |

$407K |

30% |

$100K>$500K |

40% |

$500K>$1M |

||

50% |

$1M>$10M |

||

60% |

$10M>$100M |

||

70% |

$100M > |

||

One stunning reality of the current approach to taxation is that so many Americans are grouped into the very top tax brackets. For instance, the top bracket would seem as if it should be reserved for the wealthiest Americans. And yet, individuals who would clearly be characterized by any reasonable measure as upper middle income Americans are grouped with those making millions or even tens of millions of dollars annually.

By including upper middle-income earners in this top bracket, the Reagan tax revolution has undermined progressive taxation by mischaracterizing these individuals as part of the wealthy class. Only since the Reagan era has the threshold of the top tax bracket fallen below one million dollars in inflation-adjusted income (2014 dollars). Thus many Americans have been encouraged to oppose increases on the top tax brackets because they have been politically defined as members, or near members, of the wealthiest economic class. Returning to a progressive standard where the upper brackets are reserved for the truly wealthy would reverse this negative perception regarding tax increases.

In addition, notice how artificial and irregular the current tax brackets are. In a truly progressive system, the range of the brackets should increase as the income increases to spread the tax contribution among those with a greater ability to pay. The tax percentage applied to each bracket should rise gradually to ease the burden on those with the least ability to pay. Instead the current brackets start at 10% and then jump irregularly (5%, then 10%, 3%, 5%, 2%, and then 5%). The pattern of progressivity has been undermined by a haphazard creation of tax brackets and is biased towards those with the highest income. It is evident that the current bracket organization stifles the potential progressivity of the system.

The following table contrasts the difference in take-home pay of the proposed versus the current tax structure. Notice under the proposed tax structure that all individuals whose income is under one million dollars take home an extra thousand dollars or more annually. Only those earning over a million dollars a year take home less.

We can’t imagine that this modest reduction in income would impact the ability of these millionaires to buy necessities or to invest in new businesses that create jobs. It might, however, reduce their speculative investments in pursuit of ever-higher profits that have the adverse effect of inflating ‘boom’ bubbles that must inevitably burst. In contrast, the extra money for those in the lower tax brackets would most likely be spent on deferred necessities. This tax rebate could also fund small level luxuries, such as going out to eat, new clothes, a ‘new’ used car, or a modest vacation. All of these expenditures fuel the capitalist economy in a more stable manner, while continuing to generate ever greater wealth for entrepreneurs.

Annual |

Take Home Pay |

|

|

Income |

Proposed |

Prior |

Difference |

$10K |

$10K |

$9K |

$1K |

$20K |

$19K |

$17K |

$2K |

$40K |

$37K |

$34K |

$3K |

$60K |

$54K |

$49K |

$5K |

$80K |

$70K |

$64K |

$6K |

$100K |

$86K |

$79K |

$7K |

$500K |

$365K |

$344K |

$21K |

$1M |

$665K |

$644K |

$21K |

$10M |

$5M |

$6M |

-$1M |

$100M |

$41M |

$60M |

-$19M |

$200M |

$71M |

$120M |

-$49M |

In summary, progressive taxation is a win-win economic situation for nearly everyone. This fiscal approach most equitably provides the funds that support our nation’s infrastructure. This investment in the public sector creates and repairs the vital transportation and communication networks that enable the efficient transfer of goods and services. Investment in infrastructure also provides essential public services, such as water, waste disposal, and energy distribution. Of course, funding the infrastructure is a collaborative effort between federal, state and local governments as well as private investors. But when it comes to the federal share of this critical investment in the national welfare, could a regressive or flat tax system better meet these enormous social needs? We think not.

In addition, progressive taxation is the most equitable and practical approach to provide the social safety net for the American public. Relying upon government programs as insurance against economic hardship, whether individual or societal, cushions the citizen from an otherwise harsh reality. There are times when individual citizens cannot be expected to solve, by themselves, certain crises such as medical adversity, job loss and national disasters. Supporting citizens through government assistance in times of economic crisis is an enlightened form of economic pragmatism. The pre-eminent economists Keynes and Friedman understood that supporting the economic well being of the working class is essential to a stable and growing capitalist economy.

This most practical of economic approaches clearly benefits those at the top of America’s income ladder. A strong consumer base both fuels the profits of the entrepreneurial sector of society and mitigates the devastating effects of the boom-bust cycle. Progressive taxation, in addition to its infrastructure and safety net advantages, also redirects funds away from potentially reckless speculation that frequently leads to the excessive downturns associated with an extreme boom-bust cycle. It is salutatory for wealthy Americans to remember that deep economic recessions not only affect lower income America, but also destroy fortunes. Enlightened self-interest would suggest that increasing the tax responsibility of the wealthy also better protects their investments.

In addition to these positive economic effects, progressive taxation has a positive emotional or moral component as well. This type of tax system exhibits a sense of social responsibility. Those who prosper economically have not done so in a cultural vacuum. The investments and contributions of fellow citizens and prior generations should not be underestimated. Even as great a thinker as Isaac Newton made it clear that his contributions were made while standing on the ‘shoulders of giants’.

The production of wealth is intimately tied to the stability and health of society. Taxes in the name of national defense protect the United States from the destabilizing effects of external aggression. Further, the investments that society has, and continues to make, also create the conditions that enable modern businesses to thrive. The prosperity of the entrepreneurial and professional classes in American society are inextricably linked to a healthy, well-educated labor force. Investors reap substantial profits as a result of a healthy economic culture that goes far beyond the notion of a ‘self-made man’.

It is only fitting that those who prosper the most should make a tax contribution to the Federal Government that is in proportion to their financial success. Historical and contemporary America has enabled their privileged position of affluence. The sort of myopia that leads certain successful individuals to believe that their achievements are due solely to personal talent and effort seems dramatically misguided. When we forget that our individual efforts occur within a context that includes the efforts of other individuals, both past and present, we lose our appreciation for the value of a community network.

If it appears that a primary purpose of government is to obsessively protect the wealth of the upper classes, then trust and faith in government is compromised. If on the other hand, the citizens perceive that a primary purpose of government is to protect the vulnerable and provide an infrastructure that promotes the opportunity of the many, then trust and faith in government is enhanced. When a society creates a tax system that funds its needs by focusing upon an individual’s ability to pay, the citizenry is more likely to perceive that their government is representative of a compassionate community.

This could be why scientific studies are beginning to find a positive correlation between progressive taxation and a citizen’s reported sense of wellbeing. Other studies report that progressive taxation is positively linked to citizen satisfaction with public services, such as education and transportation. It is easy to imagine that an individual’s sense of wellbeing is intrinsically connected to how equitably the tax system funds government social programs.

It may be a lot to ask to reverse the Reagan ‘tax revolution’ in one big step towards restoration of truly progressive tax brackets. A return to progressivity may require many smaller steps. One such step would be to at least eliminate the regressive nature of our tax system. That is the topic of the next two articles in the tax reform series.

Appendix: Graphs and Charts

History of Income Tax Rates adjusted for Inflation (1913-2010)

Number |

Bottom |

Top Bracket |

||||

Year |

Brackets |

Rate |

Rate |

Income |

Adj. 2014 |

Comment |

1913 |

7 |

1% |

7% |

$500K |

$12M |

1st Permanent income tax |

1917 |

21 |

2% |

60% |

$2000K |

$37M |

World War I financing |

1925 |

23 |

1.5% |

25% |

$100K |

$1M |

Post war reductions |

1932 |

55 |