Why America can afford Social Security

The 'Dirty Little Secret' of the Ruling Class

Article Summary: The Media regularly provides us with news suggesting that the Social Security System is running out of money. This notion is based upon a flawed cognitive framework. The Mass Media portrays the Social Security System as a mandatory Pension Fund for the Working Class. Outgo to Retirees exceeds contributions by Workers; so the System will 'go broke' in a few decades, goes the reasoning.

There are 2 major fallacies to this mindset. First, the Social Security System is much more than a Pension Fund. Social Security revenues are disbursed to anyone who can't work, for instance Children and the Disabled, not just Retirees. Second, the Social Security System was set up as a Social Program to provide an 'adequate income' for the elderly when they became to old to work. It was never based upon financial 'equity', as are other types of insurance or pension funds.

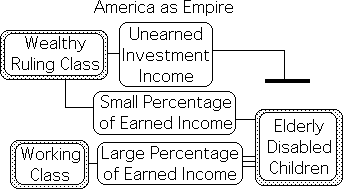

As such, the Social Security System is not a Pension Fund, but is instead a Government Program designed to assist those who are unable to work through no fault of their own. Most Government Programs, whether agricultural, education, or military, are funded by Federal Income Taxes, which are levied on both Earned and Investment Income. Currently the Social Security Program is solely funded by taxes levied on Earned Income. Social Security Taxes are neither levied on income above $120K per year nor on Investment Income. In other words, the wealthier segments of our society contribute only a very small percentage of their income to assist those who are unable to work. The bulk of Social Security funds comes from the middle and lower income earners.

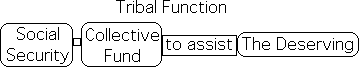

If the United States is a Tribe of Family, then everyone should contribute to the common good. Under the Tribal mindset, the solution to the Social Security shortfall is simple. There is no need to raise the Social Security percentage for the lower and middle income earners. Instead levy Social Security Taxes on all income equally, Earned and Investment. Place these funds in a general fund designed to provide security for the greater American Family. This is tax justice, as all income contributes to the greater good, not just the income of the Working Class. For a more detailed analysis of these issues, read the following article.

- Mindset determines Solvency of Social Security System

- Cognitive Science: Conceptual Frame trumps Facts

- The Tribal Model applies to many features of American Democracy

- Social Security: initially a Pension Fund for Working Class

- Current Social Security System for anyone who is unable Work

- Social Security: A Social Program that Benefits the Entire Tribe

- Working Class funds Social Security Program

- America’s Social Security Taxes based in the Empire-building Model

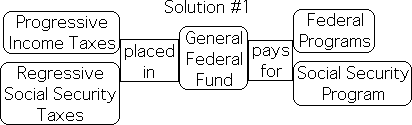

- Solution 1: Incorporate Social Security into General Federal Budget

- Solution 2: Vote the Ruling Class into the American Tribe

- Obstacles: Working Class adopts Ruling Class Values

Mindset determines Solvency of Social Security System

Is the Social Security System running out of money?

Due to a constant media barrage, most Americans believe that it is. The pundits of television, magazines and newspapers present facts, statistics, and graphs showing that more funds are going out than are coming in. The projections suggest that in a little more than a decade, there won’t be enough money in the System to take care of the elderly.

In response, workers opt for early retirement in order to get his or her share before nothing is left. The young skeptically think that their taxes are paying for the old, but that there won’t be money left in the Social Security System by the time they need it. In general, most Americans are insecure about the system that is meant to provide security in our old age. Due to its many shortcomings, some are even working to dismantle this retirement program for the working class.

If one thinks of the Social Security System from the traditional mindset, it is indeed running out of funds. However, if one thinks of the American Democracy as a Tribe or Family, where all citizens are given equal consideration, then there is plenty of money left.

What does mindset have to do with the viability of America’s Social Security system? What is the relevance of cognitive models to hard-core numbers and facts? How can perceptions possibly change reality?

Read on to find some answers to these intriguing questions.

Cognitive Science: Conceptual Frame trumps Facts

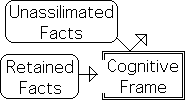

Cognitive science has discovered that humans develop conceptual frames to understand their world. We hang facts and experiences in these frames. If the facts don’t fit the frame, they bounce off or are rejected. In other words, we don’t assimilate any information that doesn’t fit into these conceptual structures. We only remember the facts that fit into the cognitive frames that we have constructed to make sense of our world.

In his bestselling book, don't think of an elephant, noted cognitive scientist Dr. George Lakoff states:

"One of the fundamental findings of cognitive science is that people think in terms of frames and metaphors – conceptual structures … . The frames are in the synapses of our brains, physically present in the form of neural circuitry. When the facts don't fit the frames, the frames are kept and the facts are ignored." (Lakoff, p.73)

Persuasion Must Communicate through Cognitive Frame

Due to the supremacy of metaphorical frame over facts, it is essential to communicate through the conceptual frame for persuasion to occur. As such, it is of utmost importance to first uncover the underlying metaphor of the cognitive frame before moving onto facts.

What is the conceptual frame behind Social Security?

To truly understand the typical US citizen's attitude towards Social Security, it is essential to illuminate the model/metaphor that is lurking behind this mindset. In cognitive terms, what is the conceptual frame by which the Social Security System is understood? What is the internal model that most Americans employ to conceptualize the retirement system that their government provides?

The American government established the Social Security System. To understand our attitude towards Social Security, we must first understand the role that we expect our government to play in our lives. What are the models or cognitive frames that we employ to understand our government’s role?

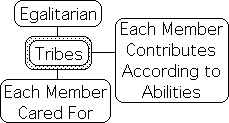

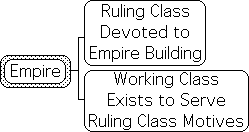

The Tribal Model applies to many features of American Democracy

Most Americans tend to think of our political system in terms of a Tribe or a Family. There are three features of the Tribe that concern us here. Tribes are egalitarian in the sense that all members, including men and women, the young and old, the strong and weak, are accorded equal respect. Further, each member contributes to the Tribe's overall welfare to the extent of their abilities. The strong work to assist the young, elderly, and disabled. Finally, all members of the Tribe, whether old, young or disabled, are cared for.

How does the Tribal or Family metaphor apply to our American Democracy?

Tribal Model: All Americans have equal rights and justice

We are certainly taught that ‘all men are equal’. In our political system, all American citizens presumably have the same rights and are treated equally under the law. Further, everyone is provided the right to an education. Although there are certainly inequities, this equality is the avowed intent of our democratic system. This presumed equality suggests that the egalitarian Tribal Model is definitely applicable to the American Democracy in terms of basic human rights, education and justice.

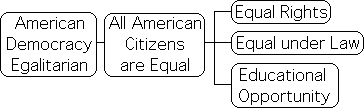

Is Tribal Model appropriate to Federal Tax System?

While certainly true regarding certain features of our society, how about our Tax System? Under the Tribal System, all citizens are equal, as in a democracy. The Tribe takes care of each member, including the disabled, elderly or young. Further, each member of the Tribe or Family contributes to the general welfare according to his ability.

Tribal Model applies to Income Taxes.

Our Progressive Income Tax System definitely reflects the Tribal Model. Those whose income is larger contribute a larger percentage of their income to the Federal Pot. Money is distributed from this Federal Pot to myriad Programs designed to benefit the general good. For instance, funds are disbursed to the Department of Defense to maintain an Army to protect the American Tribe. Similarly, funds are disbursed from this same Federal Pot to the Department of Transportation to maintain the nation’s infrastructure, for instance repairing roads. These are just 2 of many ways that money from the Federal Pot is spent for the general welfare of our society.

Which Model, Tribal or Empire, applies to Social Security Taxes?

The Income Tax is just one type of Federal Tax. The Social Security Tax in another. Indeed many individuals pay more of their hard-earned income to the Federal Government in Social Security Taxes than Income Taxes. Is the Tribal metaphor applicable to our Social Security Tax System?

Social Security: initially a Pension Fund for Working Class

Due to Social Pressure, Social Security System instituted 1935

Let’s start with some basic features of the Social Security System. Due to the difficulties of the Great Depression of the 1930s, millions of old people joined clubs, whose sole purpose was calling for a $200/month pension for anyone over the age of 60. In direct response, federal legislation was passed in 1935 that established pensions for retired people. This was the beginning of the America’s Social Security System.

A Mandatory Payroll Tax funds the System

To fund the retirement pensions, the legislation created a new tax, a mandatory payroll tax. A percentage is taken from the direct wages of the employee, which the employer matches. These special taxes are placed in the Social Security Fund. The retiree receives a pension from this Fund. The Pension is in direct proportion to the amount he or she contributed.

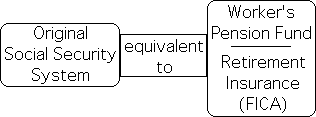

![]()

Social Security: a Federal Insurance Program, FICA, for Workers’ Retirement

Retired Workers are not paid from an individual saving account, but from a collective fund. Indeed the name of the tax reflected this function. The real name of the Social Security legislation is the Federal Insurance Contributions Act, whose acronym is FICA. Instead of individual savings accounts, the government initially set up a social insurance program for the workers. Workers paid into the common retirement pot and received funds relative to their contribution. As such, the original Social Security System acted like as a type of Retirement Insurance Program or Federal Pension Fund for the Working Class.

Collective Insurance Pot: a pragmatic necessity

This was a pragmatic necessity for several reasons. The initial recipients had only contributed into the system for a few years before receiving benefits. Further the amount of funds that were eventually received by those living a long time far exceeded their individual contributions. Indeed due to cost of living increases combined with longevity, retirees frequently receive far more money than they actually contributed to the system.

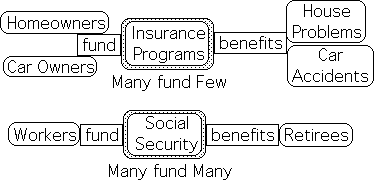

Insurance: Individual Premiums enter Collective Pot that pays for Individual Problems

This is the way all insurance programs work. We pay for health, home or car insurance. This money goes into a collective fund. Frequently, those that actually require the insurance money receive far more from the insurance company than they contributed. For instance, if someone’s house burns down, the homeowner receives far more to rebuild his house than he paid in premiums. The point of insurance is that all participants contribute towards a collective fund that assists those in need. Insurance companies regularly raise individual premiums to insure that there is enough money in the collective pot to pay for these individual disasters. Pension Funds work in a similar manner. A Collective Fund pays out money to individual Retirees.

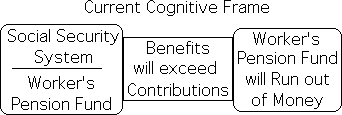

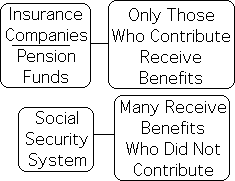

Americans in general think of the Social Security System as an enforced Pension Fund for the Working Class. This is the cognitive frame by which most of us understand the Social Security System. We perceive similar examples around us. Anyone who drives a vehicle must have car insurance by law. Anyone who buys a residence must have home insurance. Anyone who works must contribute to a Pension Fund.

Car insurance is one of the costs associated with driving a car. Home insurance is one of the costs associated with owning a home. Pension insurance is one of the costs of earning a living. Those that choose to drive a car must own car insurance. Those that choose to own a home must purchase home insurance. Those that choose to earn a living must purchase retirement insurance.

The Mass Media employs, thereby encouraging, the cognitive frame that the Social Security System is a mandatory Pension Fund for the Working Class, a type of insurance against aging. Once the frame is established, the reasoning is straightforward. This mandatory Pension Fund for the Working Class will run out of money because benefits will exceed contributions. This imbalance will deplete the Fund in the not so distant future. In other words, the Social Security Fund, the Worker's Collective Savings Account, will run out of money and won't be able to pay benefits.

However, this cognitive frame doesn't quite fit the facts, as we shall see.

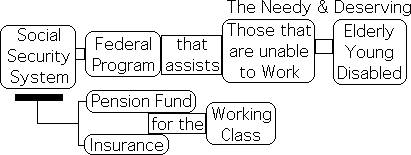

Current Social Security System for anyone who is unable Work

Pension Fund accumulates Funds; Benefits extended to Widows, Children & Disabled

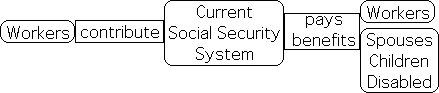

After the Social Security System was instituted, the collective pension fund began growing rapidly. Why? The contributions to the pension fund from the payroll taxes far exceeded the benefits the retirees were receiving. This was due in part to a booming economy after the Second World War combined with an expanding workforce. As such, the Federal Pension Fund began rapidly accumulating money. Perceiving this obvious trend, Congress passed legislation that extended benefits from the Pension Fund to dependents (widows and children), the disabled and related groups. These deserving individuals are unable work due to circumstances beyond their control.

Social Security Benefits extended to those who are unable to Work

At this point, the Social Security System was no longer just a collective retirement fund for the Working Class. While the original Federal Insurance Program was intended to pay a pension to retirees, it was now extended to provide funds for many others who were unable to work through no fault of their own. The System/Fund supplies a monthly stipend to a man’s family if he dies prematurely. Further spouses continue to receive the Workers’ Pension, even after they die. More importantly, the permanently disabled receive a monthly payment to relieve their potential poverty.

Social Security: Financial Security for the Elderly, Children & the Disabled

The original Social Security Program was intended to provide some amount of financial security to wage earners when they became too old to work. The expanded Federal Insurance System also provides financial security to anyone else that is unable to work – the Elderly, Children and the Disabled. In other words, the taxes collected from Paychecks go into a Collective Fund that provides financial security for other members of our democratic family who are unable to earn a living, not just the Retiree.

Social Security: A Social Program that Benefits the Entire Tribe

Many that didn’t contribute Receive Funds from Social Security

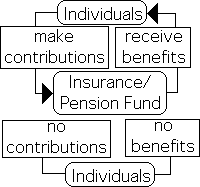

This is an important point. The current Social Security System provides financial assistance to those who are unable to work: the Elderly, Children, and the Disabled. Many of those receiving money from the Collective Security Fund did not contribute a penny to it – specifically Widows, Children and the Disabled. As such, we can’t think of the Social Security System as an insurance program or a retirement fund anymore. This is not how insurance companies or retirement funds work.

Insurance and Pension Plans: Only those who contribute receive benefits

We make regular payments to provide car insurance for our car, home insurance for our home, and health insurance for us as individuals. The insurance companies only provide funds to those who contribute to the collective insurance pot. Those who do not contribute do not receive. This is a fundamental feature of all insurance companies. Similarly for retirement funds, only those that contribute receive a pension.

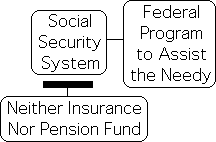

Social Security no longer a Pension Fund or a Type of Insurance.

Let us summarize to enhance retention: The Social Security System is certainly not an Individual Retirement Account, as Social Security Taxes are put into a Collective Fund. It is also neither a Pension Fund nor a type of Insurance, as money is dispersed from the Fund to significant groups of Americans who have not contributed to the System. Most of us think of Social Security as a type of Retirement/Pension Fund due to the common misunderstanding that Social Security funds are only dispersed to retirees. The government thinks of it as an insurance program, as indicated by the name FICA. However, we’ve seen that it is neither a Pension Fund nor a type of Insurance.

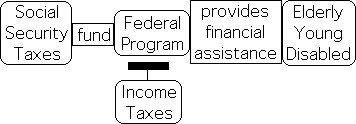

Social Security: A Federal Program

Then how can we think of the Social Security System?

Perhaps the best way to conceptualize it is as a Federal Program intended to provide assistance to the needy, in this case those who are unable to work, i.e. the Elderly, Children and the Disabled.

Money taken from Community Pot to pay for Social Programs

As mentioned earlier, Federal Programs serve multiple functions: the military, the parks, roads, police departments, education and health. Taxes are collected and placed in a Federal Fund. A Budget is drawn up. Money is dispersed from the collective Federal Fund into the variety of programs or departments. For instance, some of this collective money is employed to maintain the infrastructure – such as building and maintaining roads. This is just one of myriad ways that our tax money is spent.

![]()

In similar fashion, Social Security taxes are accumulated in a Community Fund. These funds provide some financial security to any American who is unable to work. Because many of the recipients didn’t contribute to the Community Pot, the Social Security is neither a Pension Fund nor a type of insurance, but is instead a full-fledged Social Program.

Social Programs not paid for Individually

Let us point out a significant aspect of most Federal Programs. The Federal Government finances them from the General Fund, not from a Fund that was collected specifically for the Program. In general, the Government does not levy a special tax on the individuals who use each Program.

![]()

For example, Farmers aren’t required to pay a special tax to fund the Agricultural Department. The Parks Department receives most of its money from the General Fund, not from a special tax on individuals who use the parks. Similarly, everyone’s income taxes support the Transportation Department, the Defense Department, the Education Department, etcetera. Individuals can’t opt out of contributing to a social program because they have no children in school, because they are house bound, because they don’t believe in Food Stamps or because they don’t support military aggression. All those with any type of income contribute taxes to the General Fund. Our elected leaders decide how these monies are to be spent.

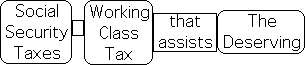

Working Class funds Social Security Program

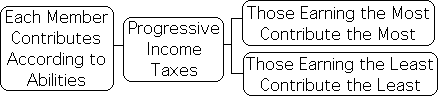

Retierating: the costs of most Federal Programs are paid for from a Collective Pot that is fed by our Progressive Federal Income Taxes. Further, the Government does not levy special user taxes to fund these Programs. Strangely enough, this is not how our Social Security System works.

First, a special Regressive tax funds the Social Security Pot. Plus, this Regressive Tax is supposedly a User-tax. Significant sections of society contribute nothing to this Federal Program, presumably because they will not use the Federal Program. Stranger still, those making the most contribute the smallest percentage of their income to the Social Security Pot.

Social Security assists those who are unable to work

Remember the sole function of the Social Security System is to provide some financial security for those who are unable to work – the Elderly, Children, and the Disabled. As such, this Social Program benefits the entire Nation by partially relieving the economic suffering of a significant section of our American Family. These individuals are not able-bodied men and women who are unemployed and can’t find jobs. Their inability to work is through no fault of their own. They are too old, too young, or too disabled to work. In other words, they are particularly deserving of government assistance. Let it be stressed again: as it provides assistance to those who have not contributed, the Social Security System is neither a Pension Fund nor an Insurance Program for the Working Class.

How is this Social Program funded?

Income Taxes fund most Federal Programs

Income Taxes fund most Departments of the Federal Government. In turn, these Departments run and organize Programs that are designed to benefit the Greater Society. The Programs can serve a variety of functions, for instance military, social, financial, or bureaucratic.

Progressive Income Taxes in line with Tribal Model

Further, as seen, Income Taxes are Progressive. This means that those who earn the most contribute the highest percentage of their income for the social good. This is totally in line with the Tribal or Family Model. Those in a position to help out come to the aid of those members of the tribe that need assistance. The strongest assist the weak; the quickest help the slow; the healthy assist those that are sick or injured; and the richest help the poor.

Social Security Program helps deserving: Tribal Model

Social Security is a Federal Program that assists the deserving – those who are unable to work. As such, its function falls in line with the Tribal Model.

Disadvantaged members of our American Society are taken care of by funds taken from a Collective Pot that is generated by Federal Taxes, in this case Social Security Taxes. Income Taxes are not employed to relieve the suffering of these deserving members of our American Family.

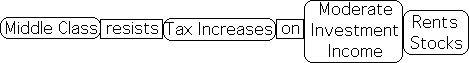

No Social Security Tax on Unearned Investment Income

Social Security Taxes fund the Collective Fund that assists the deserving nation-wide.

However, those whose who make money on investments pay no money into this Fund. In other words, Investment Income is not subject to Social Security Taxes. For instance, those making money from rents, stocks, and interest income pay no Social Security Taxes. Of course, the wealthier segments of society are the ones most likely to have Investment Income. The poorer members of society have no assets. The middle class have a moderate amount of assets, while the wealthier members of our society have an abundance of assets that can be invested in this manner. The Rich have assets that can 'work' for them.

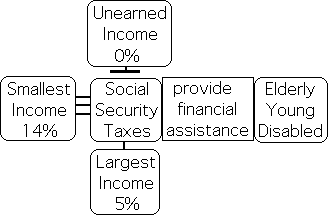

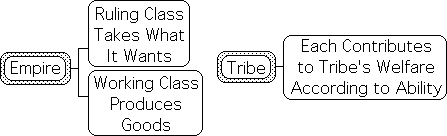

Social Security Tax: A Regressive Tax on Earned Income

Aggravating the situation, the Social Security Tax is a Regressive Tax on the Working Class (developed in a prior article). In other words, those that earn the least must contribute the highest percentage of their income to the Common Social Security Fund. Those earning $117K or less pay a little more than 14% of their income in Social Security Taxes, while those that earn the most pay the lowest percentage, less than 5%.

Social Security Tax: A Regressive Working Class Tax

In brief, the Social Security Tax is a Regressive Working Class Tax. The Workers that earn the least money pay the largest percentage of their Earned Income into the Social Security Fund, and vice versa. Further those with Unearned Investment Income pay no money into this Collective Fund that assists the Greater Society. In other words, those who are least able, the Poor Worker, funds the Social Security Program, while those who are most able, the Rich living off Unearned Investment Income, pay nothing into this Federal Fund that benefits the entire American Tribe or Family.

America: Tribe or Empire?

All Americans presumably have the same rights and receive equal treatment under the law. Federal Programs of all varieties are designed in general to benefit the Greater American Family. Progressive Income Taxes fund most of these Federal Programs. Each of these features of the American Democracy falls under the Tribal or Family Model. Each member of the Tribe or Family is treated with equal consideration. Those who are most able contribute the most to the greater good and those who are least able contribute the least.

The Social Security Program provides financial assistance to those who are unable to work. As such, the Program acts to relieve the financial suffering of a significant section of our American Family. As in the Tribal model, the Collective takes care of each member. It is evident that there are many features of our nation that support the notion that the American political system has a Tribal quality.

Unfortunately, the Social Security Tax that funds the Tribal System violates this Tribal conception of the American Democracy. Roughly speaking, the wealthier members of our society pay no Social Security Taxes on their Investment Income. Further this same class pays a smallest percentage of their income to this Fund. In contrast, the Working Poor pay the highest percentage of their income into the Social Security System. This is exactly opposite the Tribal Model. Those members of the American Tribe who are least able contribute the most, while those who are most able contribute the least.

If Social Security Taxes don't fit into the Tribal Model, what model are they based upon?

In general, Americans are inculcated with the notion that our Democracy is like a Tribe. The notions of equality, taking care of each other, and contributing according to one's ability are stressed in our universal education system.

Further, the public intent of our leaders is Tribal in nature. On a trivial level, each party, Democrat and Republican, attempts to align itself with the Working Class to procure votes. More importantly, it could be easily demonstrated that America's political system is becoming more Tribal with each successive generation. Initially only property owners could vote; now all adult citizens can vote. Less than a century ago, the Working Class had no rights; currently they have many, for instance a Federal Minimum Wage. These are just a few instances of the Tribalization of America. It is evident that the evolution of our Democracy is towards the Tribe.

If our American political system is progressing towards something, what is our Democracy evolving away from?

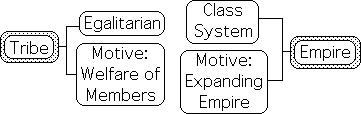

The Empire Building Model of the Ruling Class.

Many, if not most, Americans view our Democracy from the Tribal Perspective. We believe that we are equal and should help each other out to the limits of our ability. In contrast, a dominant percentage of the Ruling Class perceives the United States as an Empire. The notion that America is an Empire rather than a Tribe has some major ramifications.

Tribes emerged during the Paleolithic, when humans lived as Hunter-Gatherers. Tribes are egalitarian, classless societies. The primary function of a Tribe is the welfare of its Members. In contrast, there are at least 2 classes in the Empire Model, the Wealthy Leaders and the Working Class. Further, the primary motive of the leaders of an Empire is expansion.

The Empire Model emerged during the Bronze Age, when militaristic nomadic warriors conquered and enslaved indigenous agrarian cultures. In essence, the 'Upper' Ruling Class were Warriors, who were regularly waging war to expand their territory. In contrast, the 'Lower' Working Class were Farmers and Traders. The Ruling Class was primarily devoted to War to build their Empire. The Working Class, whether Farmer, Soldier, Craftsman, Trader or Woman, only existed to serve the motives of the Ruling Class. (This topic is developed more fully in the article – Political Models, A Brief History: Empire vs. Tribe.)

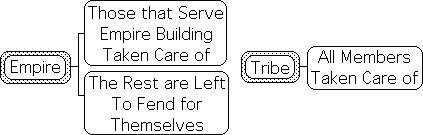

Empire's Ruling Class unconcerned with those who can't serve the Empire

The primary Leaders of the Empire only cared about the citizenry to the extent that they serve a purpose in their Empire-building. In other words, the Ruling Class with the Empire mentality only care about the Working Class as property. They care for their Soldiers while in the Army, the Workers at their Job, and Women while they can bear children, cook, and clean. But the Ruling Class is, in general, unconcerned with those who can’t serve the Empire – the Disabled and the Elderly. They must fend for themselves. This situation is in direct contrast to the Tribe where all members are taken care of.

There is one last feature of an Empire that sets it apart from the Tribe. In the typical Bronze Age Empire, the Ruling Class felt that work was beneath them. As warriors, they took what they needed. In terms of society, their primary function as warriors was to protect their property, animate and inanimate, from other warriors. Producing goods was for the Working Class. Conversely, everyone contributes to the general welfare of the Tribe according to his or her ability. While the hunters might protect the Tribe, they also procure game for food.

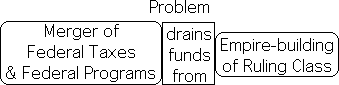

America’s Social Security Taxes based in the Empire-building Model

How do these prehistoric political models apply to American politics?

Most Americans tend to view our political system in terms of the egalitarian Tribal Model, where everyone is taken care of. The Ruling Class seems to have a different political model. As we shall see, they tend to view America is an Empire, not as a Tribe at all.

America's Ruling Class unconcerned with those who are unable to work

In the American Democracy, the Wealthy Ruling Class contributes nothing, or a very small percentage of their income, to assist the Disabled and Elderly who are unable to work. It is evident that they don’t feel any obligation to provide for the welfare of this significant segment of society. Further, the Ruling Class requires the Working Class to pay into a special Fund to assist the Elderly, Children and the Disabled. This further relieves the Ruling Class of any responsibility for these deserving individuals, who are in need of assistance. Only concerned with Empire-building, the concerns of the average citizen matter very little to the Wealthy. If they were really interested in helping out, they would lobby to pay Social Security Taxes. Instead, they regularly moan about their excessive tax burden and attempt to hide the truth. (For more on this topic, check out the article – Dispelling the Myth that the Rich need 'Relief' from their Tax 'Burden'.)

The lack of responsibility of the Wealthy for the less fortunate members of society certainly reflects the Empire Model. Only concerned with building their personal Empires, whether political or financial, the Ruling Class accumulates massive fortunes and attempts to increase personal power. Further, these endeavors are frequently at the expense of the Working Class. As in the Empire model, the Working Class only exists to serve the purposes of the Ruling Class. The Social Security System reflects these hidden motives.

2 Tier Social Security Taxes reflects 2 classes of Empire Model

Two classes are at the basis of the Social Security Tax. Those with the largest incomes, Investment and Earned, pay the least towards Social Security Taxes. Our leaders, the Ruling Class, are generally part of this class of Americans. In contrast, the Working Class pays the highest percentage of their income to this tax. Adding insult to injury: due to the cap on Earnings, the wealthiest of those working for a living pay the smallest percentage of their Earned Income. Reiterating: Unearned Investment Income, which is only available to the Wealthier segments of society, is not subject to this Working Class Tax. The method that Congress employed to levy the Social Security Tax reflects the Empire-building Model, where the Ruling Class is not meant to Work.

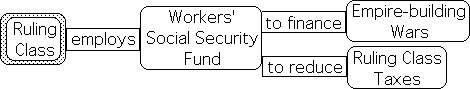

Let us offer further evidence in support of the Empire-building Model. The Working Class funds the Social Security System, which assists the Elderly and Disabled. The Social Security Fund is a type of Saving Account that accumulates money to distribute in time of need. Not only have they contributed very little, the Ruling Class has employed the Worker’s Social Security Fund to finance their political Empire building.

During the 1980s when Reagan was president, Income Taxes were lowered for the wealthier segments of society, including the Ruling Class. To make up the difference, Social Security Taxes were raised for the Working Class. Due to the decrease in Income taxes, the budget deficit grew. Due to the increase in Social Security Taxes, the Workers’ Savings Account grew astronomically. The Ruling Class employed this Worker’s Pension Fund that was solely financed by the Working Class to help balance their finances in both wars of aggression against Iraq and then Afghanistan.

Moynihan, the author of the Social Security increase, called this ‘our dirty little secret’. In other words, after lowering taxes for the Wealthy, the Senate raised the taxes on the Working Class to fund the Empire-building of the Ruling Class. It was a ‘secret’, because the Ruling Class has attempted to keep this information hidden from the Working Class.

The Social Security System: a ‘dirty little secret’ of the Ruling Class

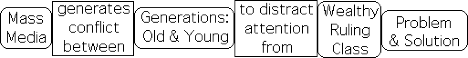

The entire Social Security System is a ‘dirty little secret’ of the Ruling Class. To distract the Public’s attention, the Mass Media only speaks about the tax burden upon the Rich and how the Social Security System is running out of money. Further, they imply that the Social Security System is exclusively a Retirement Fund for the Working Class. Never does the Mass Media reveal that the Social Security Fund assists the Elderly, the Young, and the Disabled – segments of the American Tribe or Family that have not contributed to the System. Rarely does the Mass Media speak about the Social Security Cap on Earned Income or the fact that Unearned Investment Income is not subject to Social Security Taxes. The Mass Media is hiding the fact that the Social Security System is based upon the 2-class system of the Empire-building Model, even though the rest of the American Democracy is based in the single class of the Tribal Model.

To distract Attention from the Ruling Class, the Mass Media create a conflict between the older and younger Generation

Even more maliciously, the Mass Media attempts to create a conflict between the generations. Articles and TV News ‘Experts’ imply that the Baby Boomer generation will absorb the entire Worker’s Pension Fund and that there will be no money left for subsequent generations. A further implication is that the only way to save the Social Security System is to raise the Social Security Tax Percentage. Due to the Regressive nature of Social Security Taxes, this means that the Working Class from the next generation will have to pay an even higher percentage of their meager incomes in Social Security taxes to pay for the older generation’s retirement. Instead of focusing upon the real problem and the real solution, the Mass Media creates conflict between different segments of the Working Class. This strategy distracts the attention away from the Ruling Class, the real source of the problem and the solution.

Solution 1: Incorporate Social Security into General Federal Budget

So what is the solution? There are actually 2 basic solutions. The simplest solution and most palatable to the Ruling Class is to recognize the real financial nature of the Social Security System and treat it accordingly. The only problem with this solution in terms of the Ruling Class is that funds will be drawn from Empire-building and instead spent upon the Welfare of Deserving Members of the American Tribe. Horrors! The advantage to this solution is that it doesn't require that the Rich contribute their fair share.

When the Social Security System was first instituted in 1935, it was hoped that it would be self-supporting like the Social insurance program that it was purported to be. We will refer to this as Equity. Income equals outgo.

Every solvent insurance company attempts to maintain Equity between income and outgo, else they become insolvent. Most insurance companies are able to achieve Equity because the those paying into the insurance Fund far exceed those drawing money from it. For instance, the numbers of people paying for car, flood, or home insurance far exceeds those receiving money for problems. Hardship tends be to erratic and irregular. Most don't get into car accidents. Floods and fire destroy only a very small percentage of homes. However, to insure against this possibility, insurance is procured.

In contrast to these typical types of insurance, almost all of those paying into Social Security pension insurance will be receiving benefits. Only the unfortunate few die before retirement. Further while insurance companies make one time payments to those unfortunate enough to need their services, the Social Security System makes monthly payments to those that retire, frequently for decades. Both of these features doom the Equity of the Social Security System. Too many beneficiaries receive regular payments for too long for the program to be self-sustaining.

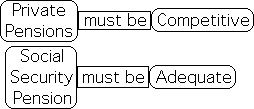

How about Social Security as the Pension Fund that it is portrayed to be? Companies offer pensions as a type of payment for services. Employee contributions combined with company profits pay for these employee pensions. Because it is a type of pay, there is no consideration as to whether it is enough for retirement. Instead the primary questions management asks are: are the benefits sufficient to keep the individual at our company? Is our retirement plan competitive?

In contrast to these private pension funds, lawmakers were forced to consider if the Social Security payments to retirees were adequate for retirement. Would it be possible for the individual who had worked for decades to survive on his pension from the Federal Goverment? This is the issue of Adequacy.

The answer was a loud 'No', if the System was based upon Equity. For instance, the minimum wage employee would starve to death and become homeless if his monthly pension payment was based upon his contributions. To provide Adequacy for retirees, lawmakers had to abandon Equity.

To this end, Congress passed legislation raising individual benefits well beyond the respective contributions. In other words, the majority of individuals receiving Social Security benefits receive far more than they contributed to the System.

![]()

If they abandoned Equity, how did Congress fund Adequacy? Did they think to themselves, let's contribute money from the General Fund to supplement the meager pension fund for the poor worker who had labored his entire life for the good of America? Or did they consider raising taxes on the Ruling Class to assist the Working Class? No, their solution was an accounting sleight-of-hand Federal Ponzi Scheme based upon population increases and inflation.

Due to the Baby Boom after World War II, many more individuals were paying into the System than receiving benefits. Because of this unusual demographic combined with rapid inflation, it seemed as if the System was paying for itself.

However looks are deceiving. It initially took the contributions of 17 workers to pay an 'adequate' retirement for 1 individual. Due to increases in the Social Security percentages, it currently 'only' takes 3 workers to fund a single retiree. However, just as with any Ponzi scheme, this situation can't last forever. With the Baby Boomers retiring and people living longer, soon there will not be enough workers to support the Ponzi scheme.

The population bubble combined with inflation are the only reasons that the Social Security SYstem has remained solvent. Lawmakers have pretended to focus on Equity, when Adequacy has always been dominant. The Social Security System has never been self-supporting due to the Adequacy requirement.

![]()

Due to the Adequacy requirement the Social Security System has never been a type of insurance or a Pension Fund. It has always been a Federal Program. Although it has seemed to be self-supporting, it never has been. No Federal Program is self-supporting. They are all funded by Federal Taxes.

Why are Congress and the Media pretending that the Social Security is a self-supporting Pension Fund for the Working Class, when they know that it isn't, or are in a state of denial. Only the most superficial of facts and statistics support the Pension Fund Model. Even the most cursory encyclopedia investigation dispels this flawed cognitive frame. Why again is the Ruling Class presenting this distorted view of reality, when they know better? Could it be that the Ruling Class does not want their Empire Building inhibited because of contributions to the welfare of the Deserving, i.e. the Elderly and Disabled?

Once the Social Security System is recognized as the Federal Program that it is, a simple solution to its supposed financial woes emerges readily. Pool all taxes, Progressive Income and Regressive Social Security, into one Federal Fund. Include the Worker's Pension Program with the rest of the Federal Programs. Treat it like the Agriculture Department or the Department of Defense. Spend money from the General Fund as is necessary and run an enormous budget deficit if required. Business as usual.

There is no need for a raise in taxes for the general population, just a shift in bookkeeping. Further this accounting shift reflects reality, while the current state of accounting is a feel-good lie that supports the Empire-building Model of the Ruling Class. What is the flaw in this simple solution? It draws funds from the American Empire and transfers it to the American Tribe. Instead of furthering the interests of the Ruling Class, the new accounting System provides Federal support for Deserving members of our American Community – the Elderly and the Disabled.

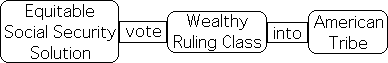

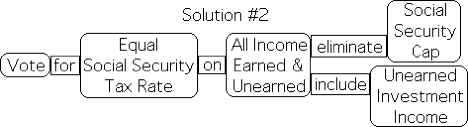

Solution 2: Vote the Ruling Class into the American Tribe

Merging Taxes and Social Programs into one Federal System is a mild solution to the Social Security dilemma. The following solution is more extreme. It is a call for Tax Justice.

Those earning the most contribute the Least

In a Tribe or Family, all members contribute to the common good to the extent of their ability. For instance, children do their chores and parents work at a job. In the American Tribe, all members contribute according their ability regarding all the Programs that are funded by the Federal Income Tax. However the Ruling Class somehow feels exempt from helping out those who are unable to work – the Elderly, the Disabled and the Young. The Unearned Investment Income of the Wealthy is not subject to the Social Security Tax that assists this deserving segment of the American Family. However, the Earned Income of the Working Class is. Only those earning a paycheck must contribute a percentage of his or her income to the Social Security Fund. Strangely enough, those that earn the least must contribute the highest percentage to the Common Fund, a little more than 14%, while those that earn the most pay the lowest percentage, less than 5%.

Wealthy feel no obligation to greater society

This might seem a bit odd. In a real Family or Tribe, those earning the most would at least contribute the same percentage as those earning the least. However, the Wealthy Class somehow doesn't feel impelled to contribute the same percentage of their income as everyone else to this Fund for the Deserving. Although many are wealthy beyond imagining, they actively resist assisting those Deserving Members of the American Tribe who are unable to earn income through no fault of their own. Indeed to avoid helping out, they have required the Working Class to generate a Fund, to assist those members of the American Family that are unable to work.

The Mass Media regularly suggests that the Social Security System is running out of money due to expanding expenditures. How is this problem solved? In the 1980s, the Ruling Class voted to reduce Income Taxes on the Wealthy and raise Social Security Taxes on the Working Class.

This is an unacceptable solution. The real solution is straightforward. Vote the Wealthy Ruling Class back into American Family/Tribe.

To avoid contributing to the greater welfare the Wealthy Class has set up a 2-class system regarding those who are unable to work. Vote to abolish the 2-class system. Vote to return to the single class system of the American Family or Tribe.

What does this mean? Vote for a flat Social Security tax that applies to all Income equally. In other words, vote to abolish the Income Cap. Vote to abolish the exemption on Unearned Investment Income.

To accomplish this task, it is essential to perceive the American Populace as a Tribe or Family. Don’t accept the current two-class cognitive frame regarding the American Democracy. Don’t accept the current cognitive frame that presents the Social Security System as a Pension Fund for the Working Class. Instead the Social Security System is a Social Program that assists the deserving – those who can’t work – the Elderly, Children and the Disabled. Don’t accept the current cognitive frame that holds that the Wealthy do not need to contribute to the welfare of this section of our American Society.

Anytime anyone suggests that the Social Security System is running out of funds respond with the obvious solution. Let the Social Security Tax Percentage be applied equally to all Income, Earned and Unearned. There is plenty of money in the American System to take care of those who are unable to work. The Working Class should not be the only ones contributing to the welfare of these deserving citizens of our American Tribe. Anyone earning money should contribute equally.

Don’t count on the Ruling Class to make these changes. A grass-roots movement is necessary. Women protested to obtain the right to vote. The elderly protested to obtain the Social Security System. The American citizenry protested to end the draft and the Vietnam War. In the same way, it is necessary for the American citizenry to demand tax justice regarding the Social Security System. A Progressive Tax is unnecessary. A flat Social Security tax is sufficient to provide more than enough funds to keep the Social Security System solvent.

Obstacles: Working Class adopts Ruling Class Values

The main obstacle to Tax Justice is our American Empire-building mentality. The mentality excludes assistance to any who are not serving our intent to build a private Empire. Most Americans have this mentality to some extent, not just the Wealthy. Each of us wants to build our own mini-Empire. We accumulate savings accounts to fund our Family Empire, which includes the health and welfare of our children as well as retirement. We are reluctant to contribute to the welfare of those unassociated with our Family.

Further and more insidious is a simple fact. The demarcation between the Wealthy and the Middle Class is not clearly defined. In other words, many in the Middle Class benefit from Unearned Investment Income. Those with any savings earn interest on this money. Many invest in stocks, perhaps in the form of mutual funds. Some buy an investment property to supplement their income. Landlords and stockholders are not necessarily wealthy. In fact because they are not wealthy, they might resist additional taxes on their investments more vehemently than the more well-to-do.

This resistance has to do with the Empire-building mentality. Everyone builds their nest egg to fund their private Empire and resists aiding the less fortunate members of our American Tribe. This attitude is also related to America’s materialist mindset. We feel that we will be happier and more secure if we only have more money. We rarely think that we will be happier and more secure if our American Tribe is happier and more secure. As such, members of the Working Class will resist assisting those who are unable to work because it could take a bite out of the assets that fund their mini-Empire.

Be aware of the roots of the resistance. Don’t succumb to personal materialism or Empire-building mentality. Wait for the wind to change. Be relentless with pressure on the Wall. Don’t give in. An opening will present itself. Most importantly resist the current cognitive frame associated with Social Security. It is not a Pension Fund, but a Fund for those who are unable to work. Everyone should contribute to the Fund, not just the Working Class. Remember America is a Democracy. The majority rules. Demand Tax Justice. Power to the People. It’s time to change the System.