Introduction

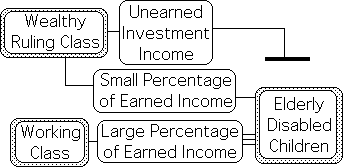

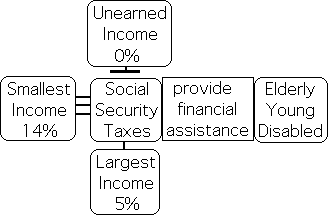

Even though the SSS is intended to help alleviate the financial hardships of deserving Americans, this intention is belied by the fact that those with the smallest income pay the largest percentage of their annual income in Social Security Taxes. Both Earned Income above a set threshold and all Unearned Investment Income, primarily the province of wealthier citizens, are completely sheltered from the SS Tax Base. Ironically Congress has chosen to fund the SSS by taxing roughly the first $120K of Earned Income, the province of the working class. The result of this strange distribution of the SS tax responsibility is that those with the largest incomes pay a disproportionately smaller percentage of their annual income to assist the deserving.

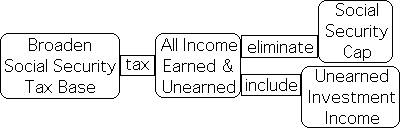

To address SS’s supposed shortfall, we suggest two obvious points. 1) The SSS serves a high moral purpose by creating the basis of a viable social safety net. 2) We can easily remedy any monetary shortfall by expanding the SS Tax Base. Let all forms of income, both Earned and Unearned Investment Income, be taxed equally. Just as all income is included in the Federal Income Tax Base, all forms of income should also be included in the SS Tax Base. Why should so much of the income of our wealthier citizens be sheltered from this fund that assists a wide range of deserving Americans? Read on for details.

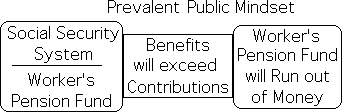

Prevalent Mindset: Social Security running out of Money

Could Mindset determine the Social Security System’s Solvency?

Is America capable of adequately funding an effective retirement system for the elderly? Or is the Social Security System running out of money?

Due to a constant media barrage, most Americans believe the latter statement. Many pundits of television, magazines and newspapers present ‘facts’, statistics, and graphs showing that more funds are going out than are coming in. The projections suggest that in a little more than a decade, there won’t be enough money in the system to take care of the elderly.

In response, the middle-aged worker may opt for early retirement in order to get his or her share before nothing is left. The young often skeptically think that their taxes are paying for the old, but that there won’t be money left in the Social Security System by the time they need it. In general, most Americans are insecure about the system that is meant to provide security in our old age. Due to its perceived shortcomings, some are even working to dismantle this government program that they consider to be a mandatory retirement savings for the working class – a required government Pension Fund.

Retirement, Survivors and Disability Insurance

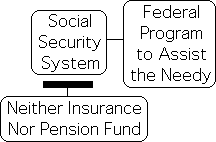

But is the Social Security System strictly a Pension Fund for the elderly? Even a cursory examination of the program’s name suggests otherwise. On the letterhead of the Social Security Administration is the phrase ‘Retirement, Survivors and Disability Insurance’. This language clearly indicates that SS attempts to address a broader social intention.

The title of the program does in fact include the word ‘retirement’, which suggests a pension-like purpose. However Social Security also uses the word ‘insurance’, which suggests other purposes than just a pension plan. The title indicates that the Social Security System has been designed to provide some kind of social insurance for 3 classes of deserving American citizens – retirees, survivors and the disabled.

This title seems to strongly suggest that the program does not limit itself to a single purpose. The legislation that created the Social Security System recognized that 3 groups of our fellow citizens were particularly in need of some form of economic social assistance. The name they’ve intentionally chosen obviously includes the word ‘insurance’ for a reason. Providing insurance for these groups is a key component of any viable social safety net.

However the use of the term ‘insurance’ can be misleading. Typically insurance covers unusual events that occur sporadically. There was some wisdom in the use of the word ‘insurance’ as applied to a broader human experience, such as retirement. We use insurance as protection from harmful events that would otherwise be overwhelming. The difference is that when we use the word insurance and apply it to the experience of all aging workers, we are no longer talking about atypical events, but rather a condition we hope to and expect to experience.

Private vs. Public: Insurance and Pensions

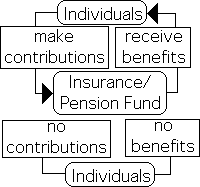

If Social Security is not exclusively a pension fund, how are we to understand Social Security? It is perhaps useful to view Social Security through the metaphorical frameworks of both a private pension fund and an insurance program. However, these models are from the private sector and therefore represent narrower purposes.

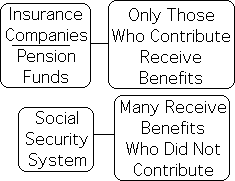

What are some differences between a private and public insurance program? Car and home insurance only honor claims to those who have paid their premiums. These companies certainly can’t afford to stay in business if they pay out settlements to the uninsured. Because solvency is of utmost importance for private businesses, the notion of ‘social security’ for the deserving does not even appear on their radar screen.

In contrast, public insurance honors the legitimate claims of all of its citizens, rather than limiting the claims to those who have paid into the system. If Social Security is truly a type of social safety net, then solvency is secondary to providing financial relief for the deserving. We must remember that a social insurance program has loftier goals than any private pension fund or insurance program.

As mentioned those paying premiums fund private insurance companies. How is the Social Security System funded? It is common knowledge that federal taxes are withdrawn from every paycheck. Then at retirement age, retirees receive a monthly payment that is proportional to how much they have paid into the system. In terms of funding at least, Social Security seems to be virtually identical to a private Pension Fund. Those paying into the system receive a monthly stipend according to their contribution.

Recall however that Social Security deems itself a [social] insurance program for survivors and the disabled, not just retirees. It seems that Social Security is funded in a similar manner to a retirement pension, but that it’s function is like a federal program that provides a social safety net for those in need.

Most federal programs, social and otherwise, are paid for out of the general fund. For instance, when there is a disaster like the flooding of New Orleans from Hurricane Katrina, federal assistance is dispersed from the general fund to provide social assistance for the deserving. These deserving citizens are provided with disaster relief according to their needs. This federal relief is not limited to a proportion of the amount of taxes they have paid.

Federal taxation on all types of income provides revenue for the general fund. Is this also true of Social Security? If Social Security is indeed a social insurance program for the needy, it would certainly seem that all forms of income should pay into this common pot.

Unfortunately, as we shall soon see, significant sources of income are excluded from the Social Security Tax Base. Further it will become clear that the wealthier segments of society contribute the smallest percentage of their income to this social insurance program. Why should those with the greatest income contribute the least to this program that provides for vulnerable members of our American society, i.e. the disabled, survivors and the retired?

If our mindset is that the Social Security System is a Pension Fund for workers, it makes sense that the wealthy should contribute a smaller portion of their income, as they don’t need to rely on this program for financial protection when they retire. However, if Social Security is instead a Social Insurance Program for the deserving, this perspective definitely seems flawed.

Why should some forms of income be sheltered from the tax base of a federal social insurance program that contributes to the common good? Shouldn’t everyone contribute at least an equal percentage of their income to assist deserving Americans? Do those with the greatest income feel they deserve a larger exemption from helping out many of our most vulnerable citizens? We certainly hope not.

Read on to find some answers to these intriguing questions.

Social Security initially a Pension Fund for Working Class

Due to Social Pressure, Social Security System instituted 1935

Roosevelt’s Social Security Act, 1935

To provide context, let’s start with the history of the Social Security System.

Due to the difficulties of the Great Depression of the 1930s, 5 million elderly people joined Townsend Clubs nationwide. The sole purpose of these ‘clubs’ was calling for a $200/month pension for anyone over the age of 60. Pressured in part by this mushrooming social movement, Roosevelt set up a committee to investigate and make recommendations. On August 14, 1935, Congress passed the Social Security Act. This legislation provided national old age pensions for the first time in American history. This was the beginning of America’s Social Security System.

A Mandatory Payroll Tax funds the System

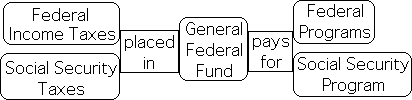

To fund the retirement pensions, the legislation created a new tax, a mandatory payroll tax. A percentage was and is taken from the direct wages of the employee, which the employer matches. These special taxes are placed in the Social Security Fund, rather than in an individual saving account. The retiree receives a pension from this general fund. The Pension is in direct proportion to the amount he or she contributed.

![]()

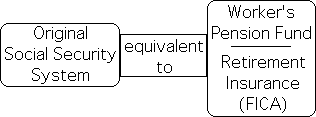

In this way, Social Security is similar to a private pension fund. The worker’s pension is in direct proportion to contributions.

The catastrophic experience of the Great Depression provided the necessary sense of urgency to address the particular economic vulnerability of retired Americans. Their diminished earning power created a greater need for a secure source of income in their later years. The Social Security System filled this role. But is its role limited to retirees?

Social Security: a Federal Insurance Program, FICA, for Workers’ Retirement

The real name of the original Social Security legislation is the Federal Insurance Contributions Act, whose acronym is FICA. Insurance what does that mean? The central purpose of an insurance program is to protect members against a loss that would present some kind of hardship. This government insurance protects retirees against the inevitable loss of earning power and the attendant hardship. As such, the original Social Security System acted as a type of Retirement Insurance Program or Federal Pension Fund for the Working Class.

Social Security System expands to include Widows, Orphans & Disabled.

SSS accumulates Funds

After the Social Security System was instituted, the collective pension fund began growing rapidly. Why? The contributions to the pension fund from the payroll taxes far exceeded the benefits the retirees were receiving. This was chiefly due to the fact that from the outset there were far more workers contributing than retirees drawing on the fund.

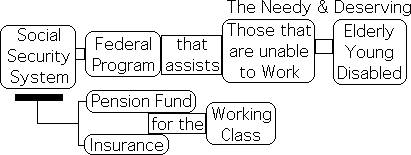

Benefits extended to Widows, Children & Disabled

This growing surplus offered Congress the opportunity to expand the program beyond retirees. They decided to include other identifiable groups of Americans who should not be expected to work due to circumstances beyond their control. Congress quickly passed legislation that extended benefits from the SS Fund to dependents (widows and children), the disabled and related groups.

This legislation sensibly included these economically vulnerable Americans along with retirees under the umbrella of a secure social insurance program. In other words, the Social Security System was quickly expanded well beyond its original purpose as a Worker’s Pension Fund. It embraced a humane approach to providing a viable social safety net for identifiable groups that we do not reasonably expect to work.

Social Security: Financial Security for the Elderly, Children & the Disabled

The original Social Security Program was intended to provide some amount of financial security to wage earners when they were no longer reasonably expected to work. The expanded Federal Insurance System soon provided financial security, not only to retirees, but to other categories of citizens that were not expected to work – survivors and the disabled. From early on in the program’s history, it has provided a predictable source of subsistence income for these groups. For this reason, the Social Security Program currently refers to itself, but as ‘Retirement, Survivors and Disability Insurance’. As such, this government program is much more than just a pension fund or insurance fund for retirees, as it is frequently portrayed and conceptualized.

The advent of social security in America represents a humane and innovative approach to creating what is often called a social insurance program. Whether it was motivated by compassion for the suffering of our fellow citizens and/or by other political considerations, this program was intended to help protect economically vulnerable Americans from severe financial hardship. The values this program embraces represent America’s greatest social legislation in the 20th century.

Social Safety Net vs. Private Business: Adequacy vs. Equity

Much of the current critique of the Social Security System appears to result from a misunderstanding of the historical context and purpose discussed above. Because the government program includes insurance in its title and provides a pension for retirees, it is understandable that many would assume that the private marketplace would provide an appropriate economic model. This misunderstanding, whether genuine or manufactured, must be dispelled before we can understand the true wisdom behind our Social Security System.

As we’ve seen, certain elements of the Social Security System display features that are similar to private pensions. Further social insurance programs and private insurance companies also share certain similarities. Yet we have also noticed that there are dramatic differences between the ultimate purposes of the private and public sector. These differences surround the issue of Equity vs. Adequacy.

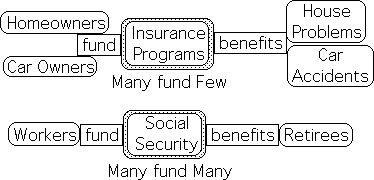

When the Social Security System was first instituted in 1935, some legislators argued that the program should be self-supporting like a private business. For any private company to stay in business, income must equal (or exceed) outgo. We will refer to this notion as Equity.

To remain solvent, every insurance company attempts to maintain Equity between income and outgo, else it becomes insolvent. Most private insurance companies are able to achieve Equity at any given time because those paying into the insurance fund far exceed those drawing money from it. For instance, the number of people paying insurance premiums for car, flood, or home insurance far exceeds the number of those filing claims. Hardship tends to be erratic and irregular. Most don't get into car accidents or have floods or fires destroy their homes. However, insurance is procured to insure against these possibilities.

In contrast to these typical types of insurance, almost all of those paying into Social Security retirement insurance will be receiving benefits. Only the unfortunate few die before retirement. While insurance companies make one-time payments to those unfortunate enough to need their services, the Social Security System makes monthly payments to those that retire, as well as survivors and the disabled. Frequently these payments can last for decades. Both of these features doom the Equity of the Social Security System. Too many beneficiaries receive regular payments for too long for the program to be considered self-sustaining.

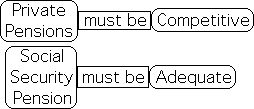

Since these payments represent an essential element of a social safety net, their purposes go far beyond a private insurer’s conception of Equity. Rather than pursing financial profit (equity), lawmakers chose to consider whether Social Security payments were ‘adequate’ for survival. For instance, would it be possible for the individual who had worked for decades to survive on his pension from the Federal Government? This is the issue of Adequacy. This higher social goal of Adequacy was another feature that doomed the prospect of Equity in the Social Security Program.

If the Social Security System was based upon Equity, then a worker’s monthly pension payment would be based upon his/her contributions. In many cases, an individual’s contributions would not be sufficient to provide for basic survival needs. This insufficiency could be attributed to many factors previously discussed, for instance inflation and longevity. To provide Adequacy for retirees, lawmakers had to abandon the goal of Equity.

To this end, Congress passed legislation raising individual benefits independent of the actual contributions. In other words, the majority of individuals receiving Social Security benefits receive far more than they contributed to the System.

![]()

In contrast, private companies offer pensions as a type of payment for services. Employee contributions combined with company profits pay for these employee pensions. Because it is a type of pay, there is no consideration as to whether it is adequate for retirement. Instead the primary questions management asks are: Is our retirement plan competitive? Are the benefits sufficient to keep the individual at our company?

Private pensions are a type of payment for services. As such, the pensions must be competitive, but the companies must also remain solvent. In contrast, Social Security aims to provide a social safety net for the deserving. Due to this purpose, the pension must be ‘adequate’.

America’s Changing Demographics & Funding an Adequate SSS

If they abandoned Equity, how did Congress fund Adequacy?

After World War II, many more individuals were paying into the system than were receiving benefits. Because of this unusual demographic, the System was able to pay for itself at a very low tax rate, while also generating a surplus for future generations.

However looks can be deceiving. It initially took the contributions of 17 workers to pay for an 'adequate' retirement for 1 individual. Due to the demographic idiosyncrasies of that earlier age, the American work force had the abundant numbers to provide an ‘adequate’ pension for all retirees. Over the years, the ratio between the labor force and the number of retirees has reduced significantly.

In order for Congress to continue to provide an ‘adequate’ social safety net for retirees, disabled and survivors, they chose to increase Social Security tax rates. Because of these adjustments, it currently takes 'only' 3 workers to fund a single retiree. The labor force is currently large enough to fund this social commitment.

Whenever the SSS has faced funding shortfalls in the past, Congress has chosen to raise the SS Tax Percentage of the working class. However, this traditional solution doesn’t work any more. The working class is tapped out. Their financial resources are stretched to the limit.

Further, America’s demographics are changing once again. With Baby Boomers retiring and people living longer, there are new stresses placed upon the Social Security System. Fewer workers will be asked to shoulder the funding for a growing number of prospective recipients. This anticipated ‘crisis’ for the SSS must ultimately result in either reduced benefits or increased federal taxes. Clearly, a reduction in benefits would be a dramatic shift away from a commitment to ‘adequately’ provide for particularly vulnerable American citizens.

And yet most critics of the SSS appear to be prepared to abandon this historical dedication to Adequacy. They claim that the program is incapable of supporting itself in the future and is therefore unsustainable. They argue that if this program cannot remain in the black, then benefits should be cut. The models that appear to be driving this type of reasoning are derived from the private market place, where concerns for Equity dominate decision-making.

As previously explained, these Equity models from the private sector are totally inappropriate for the SSS, which has always pursued the higher social goal of Adequacy. This social goal is rooted in a humane democratic response to the historical economic suffering of our fellow citizens. This response was prompted by the excesses of the private market place that resulted in the financial catastrophe known as the Great Depression.

The notion of reducing benefits as a response to anticipated shortfalls from current tax rates is something that Congress has periodically considered. Yet each time that demographic changes have threatened the bottom line, Congress has rejected benefit cuts and has instead raised SS tax rates. As America’s demographics continue to change and the ratio between labor force and SS recipients continues to shrink, the idea of further increases in SS tax rates is being considered once again. However this approach is becoming problematic because it will inevitably inflict a greater and greater burden upon those least able to afford it, i.e. those earning a paycheck.

The understandable reluctance to further increase tax rates on earned income would appear at first glance to strengthen the position of those who call for benefit cuts. Yet America need not abandon the social goal of Adequacy in response to these changing demographics. There is another quite reasonable solution to funding the SSS at levels that can continue to provide Adequacy for the foreseeable future.

Current Funding for the Social Security System

Before we can effectively discuss changes to funding the SSS, we should have a clearer understanding of how the current tax system works.

For the IRS, there are 2 types of income – Earned and Unearned. Earned Income typically consists of wages, commissions and individual profits from a private business. Unearned Income typically consists of earnings from investments such as dividends, interest, rents, and the sale of property. As such, Unearned Income is fairly equivalent to Investment Income.

The SSS is funded by a special tax that is limited to Earned Income. The Social Security Tax (OASDI) is a flat tax that is deducted from every paycheck. The current rate is 6.2%. This tax is matched by an equivalent contribution from the employer. However, employers typically consider their share of this tax to be a part of their labor costs and hence a factor in determining their employees’ wage scale. Ultimately this attitude generates a functional tax rate of 12.4% on individual wage earners. Private business owners must also pay this combined percentage on their income. (For a more in depth discussion on this topic check out 'Social Security: The Working Class Tax' – a section in the first article in our series – ‘How Progressive is the US Tax System?’).

However, these percentages present a distorted picture. All income is not taxed at this rate. In fact 2 significant sources of income are excluded from the tax base for SS. The first exclusion is commonly referred to as an Income Cap. The second exclusion is for what the IRS deems Unearned Income, i.e. Investment Income.

In government terminology, the Maximum Tax Base for Social Security is $117K per person as of 2014. In popular lexicon, the Income Cap is $117K. The Social Security Tax is a flat tax, not on all Earned Income, only on Earned Income up to $117K/year. Earned Income above $117K is not subject to mandatory withholding. In other words, an individual earning an annual salary of one million dollars only pays SS taxes on the first $117K. This million-dollar earner benefits from this first type of SS tax shelter by paying the same exact amount in annual Social Security Taxes as does the much less affluent individual earning $117K.

This discrepancy is aggravated when one considers the second area where income is sheltered from the SS Tax base. Unearned Investment Income is also not subject to Social Security Taxes. These forms of sheltered income include:

• Stocks earnings

• Dividends

• Interest earnings

• Property Sales

• Rent

• Corporate Profit

In other words, no Social Security Taxes are paid on income derived from investments. Of course, the wealthier segments of our country are the ones most likely to be earning money in this fashion. It is primarily these individuals who have sufficient assets to generate significant Investment Income.

Reiterating for retention: Currently Social Security Taxes are only applied to Earned Income under $117K/year. Both Earned Income above $117K/year and Unearned Income are exempt from the Social Security Tax.

These exemptions seem curious when we consider that the SSS provides economic assistance not only for Retirees, but for Survivors and the Disabled as well. Ironically, those earning the most contribute the smallest percentage of their income to the collective Social Security Pot that provides for these deserving citizens. Unearned Investment Income, primarily the province of the wealthy, is not part the SS Tax Base. Further, the well-to-do even pay a smaller percentage of their Earned Income into the SS Fund, than does the standard wage earner.

In fact, those earning a million dollar salary only contribute 5% of their Earned Income to the SS Fund, while the bulk of the American citizenry, i.e. those earning less than $117K/year, contribute over 14% of their Earned Income.

It is difficult to overestimate the importance of the SS safety net to millions of deserving individuals. The future security of the SS fund for our Retirees, Survivors and the Disabled Citizens could very well depend upon addressing these 2 substantial categories of sheltered income, i.e. the Income Cap and Unearned Investment Income. In our view, the solution to the future funding of the SSS lies in these 2 currently sheltered elements of the potential SS Tax Base.

Solution 1: Employ the Medicare Template to broaden the SS Tax Base

Is there a simple solution to the supposed Social Security shortfall?

There are 2 obvious ways to dramatically increase the SS Tax Base. First, eliminate the Income Cap by making all Earned Income subject to Social Security Taxes. Second, eliminate the exemption on Unearned Investment Income above a certain limit.

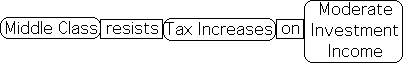

Many middle class Americans, not just the wealthy, are suspicious of any suggested increase in federal taxes. If we are able, we make investments and accumulate savings in order to support our family, which includes the health and welfare of our children. Plus we would like to amass a little nest egg to provide for unexpected medical costs and retirement. When we hear about proposed increases in federal taxes, we suspect that our ability to save will be compromised.

Further and more insidious is a simple fact. The demarcation between the Wealthy and the Middle Class is not clearly defined. In other words, many in the Middle Class benefit from Unearned Investment Income. Those with any savings earn interest on this money. Many invest in stocks, perhaps in the form of mutual funds. Some buy investment property to supplement their income. Landlords and stockholders are not necessarily wealthy. In fact, the Middle Class might resist additional taxes on their investments even more vehemently than more well-to-do Americans.

It is simple to relieve this middle class anxiety about increased taxes on Investment Income. We need only employ the Medicare template.

Initially the Medicare Tax Base was identical to the Social Security Tax Base, albeit levied at a smaller percentage. During the 1990s, the Clinton Administration eliminated the Income Cap from the Medicare Tax Base, presumably in an effort to protect this valuable component of the social safety net. In similar fashion, we propose eliminating the Income Cap ($117K/year in 2014) from the Social Security Tax Base.

| Before Clinton | After Clinton | |

|---|---|---|

| Earned Income below Cap | 2.9% |

2.9% |

| Earned Income above Cap | 0% |

2.9% |

Then in the 2010s, the Obama Administration introduced the Medicare Surtax as part of the Affordable Health Care Act. This surtax included Unearned Investment Income in the Medicare Tax Base for the first time. This tax was designed to more effectively target those citizens with a greater ability to pay. This was accomplished primarily by creating threshold income levels – $200K/year for individuals and $250K/year for couples.

Clearly most members of the middle class were not expected to pay higher taxes, while those earning above these thresholds were subject to this new Medicare Surtax. Investment Income is only subjected to the Medicare Tax when the Combined Income (Unearned plus Earned Income) of a citizen(s) exceeds the thresholds. No new taxes were levied upon the Investments of those with Combined Income below the $200K/$250K thresholds – in other words, the vast majority of working class Americans. (For more detail, read the third article in our series – ‘Applauding the Medicare Surcharge: A Step towards Tax Justice'.)

Check out the following table for details.

| Before Obamacare | After Obamacare | |

|---|---|---|

| Net Investment Income when Total Income is below threshold* | 0% |

0% |

| Net Investment Income when Total Income is above threshold* | 0% |

3.8% |

* Threshold: $200K (individual) or $250K (couple)

This same formula could readily be applied to the Social Security Tax Base in order to both increase revenue and protect Middle Class Investment Income from this tax increase. Congress could set threshold limits above which only the Investment Income of wealthier Americans would be subject to this new proposed SS Tax. The Combined Income of the typical middle class wage earner is certainly much lower than the suggested threshold. Under this proposal, SS taxes would remain the same for those earning less than these threshold amounts.

Our proposed solution would greatly increase SS revenue by targeting those with the greatest ability to pay. This increase in the SS fund would also allow Congress to implement an additional step towards tax justice. We could identify those with the least ability to pay SS Taxes and provide them with some tax relief. We could set a minimum threshold below which Earned Income is not subject to SS taxes or is taxed at a substantially lower rate. This tax reduction would place more money in the pockets of those workers who are at the bottom of the income spectrum. Perhaps this tax reduction would enable these unfortunate individuals to pay for some deferred necessities, such as medical care or education.

Some would argue that the plan to increase SS taxes on those with the greatest to pay is flawed. They worry that a larger tax responsibility for our wealthier Americans would also entail greater benefit payments. Due to these possible benefit increases for wealthier taxpayers, the solvency of the SSS would still be compromised. However, recall that SS funds are intended to create a social safety net for Retirees, Survivors and the Disabled. The central goal is to provide an adequate minimum monthly income below which no citizen should be expected to fall.1 For budgetary reasons, Congress could set maximum benefit levels to reflect this limited intent of the SSS.

Solution 2: Incorporate Social Security into General Federal Budget

Clearly, it is quite feasible to expand the SS Tax Base. The Medicare System has implemented both of the changes we’ve proposed with great benefit to the longevity of the program. What if Congress lacks the political will to implement these proposed solutions? Would that mean the end of Social Security as we know it? We would say ‘No’.

Even if increases in SS Taxes were not implemented, the Federal Government could simply choose to fund the essential SSS as it does so many other national programs. The US Congress is empowered to establish spending priorities. We believe that we have made a strong case for the importance of the social safety net that the SSS represents. As such, Congress has the power to put this program near the top of its spending priorities.

Congress could combine taxes, Income and Social Security, into one Federal Fund. Include the Retirement, Survivors and Disability Insurance with the rest of the Federal Programs. Treat it like the Agriculture Department or the Department of Defense. Spend money from the General Fund as is necessary and run a budget deficit, if required. Business as usual for the US Congress.

If Congress lacks the courage to expand the SS Tax Base, they can always resort to their form of ‘creative’ bookkeeping to afford ‘social security’. Our wealthy society certainly has the funds to mitigate economic hardship for the deserving.

Summary

This 4th article in our tax justice series discusses the current supposed crisis over the solvency of the Social Security System. This ‘crisis’ led us to an investigation of the equity as well as the revenue potential of the SS Tax Base. Our research included the history as well as the humanitarian purposes behind the creation of the SSS.

The Great Depression was clearly the catastrophic economic event that prompted the first SS legislation. The widespread and deep suffering of the American people during this era led Congress to establish the foundation of what is now called our social safety net. It became unthinkable to leave vulnerable Americans subject to the massive economic dislocations associated with capitalism’s boom-bust cycle. Without government assistance, the health and welfare of millions of Americans would be threatened by the vagaries of the economic marketplace.

A careful examination of the history of SS reminds us that this program is more than a mandatory government pension fund. Instead of just retirees, the system quickly began to provide for the Disabled and Survivors – those who are not expected to work by a humane and reasonable society. Adequacy required Congress to pursue purposes that are not those of private companies. Further it became clear that it is not particularly useful to characterize SS as a private pension.

Our solution provides a massive infusion of tax revenue into the SSS, while at the same time protecting those with the least ability to pay additional taxes.

To balance the Social Security ledger, we merely suggest applying the Medicare Tax template to Social Security. Remove the Income Cap and include Unearned Investment Income in the SS Tax Base. Further, as with Medicare, there would be a threshold on Unearned Income. Only Investment Income above a certain level would be subject to SS Taxes – a Reverse Income Cap of sorts.

Our proposal could also be easily used to provide some tax relief for those near the bottom of the income ladder. One simple way to provide tax relief would be to apply a Reverse Income Cap to Earned Income. Earned Income below a certain level would be excluded from the SS Tax Base.

Footnote

1 California State Teacher’s Retirement System: “Social Security was designed to protect those with low lifetime earnings from poverty during retirement.”

Tax Justice: More Articles

1. A Brief History of Deregulation & the Beginning of Free Market Capitalism: How free market capitalism results in the first Ponzi scheme; the near bankruptcy of France; peasant starvation; and then the French Revolution. Why regulation is mandatory.

2. A Brief History of Progressive Taxation: How progressive taxation combined with a social safety net tempers the boom-bust cycle that is innate to free market capitalism.

3. Why the US Tax System is not Progressive: The Tax Burden Myth: How Social Security is a Working Class Tax. How Unearned Income, the province of the wealthy, is not included in SS's tax base.

4. Obama's Medicare Surtax: first time Unearned Income taxed for Social Safety Net: How Obamacare includes Unearned Income for the first time ever in the tax base of Medicare – still not SS. How a Reverse Income Cap ($200,000) shelters the small investor from this tax. Why the Wealthy are afraid to confront this revolutionary precedent: the same process could be easily applied to SS taxes.

5.A Brief History of the Social Security System & Why it is Affordable: How the Social Security System benefits many classes of deserving American citizens besides the working class. How the SSS could be afforable for many decades to come by merely including Unearned Income, the province of the wealthy, in its tax base.

6. A Brief History: Empire vs. Tribe How the Tribal model of government is egalitarian. How its primary focus is to both protect and encourage the growth of all citizens. How the Empire building model is hierarchical with the wealthy on top and the rest treated as disposable property. How its focus upon the military conquest of weaker cultures. How this dichotomy manifests in our classist tax system. How the wealthy avoid contributing their fair share to the good of the citizenry.